Bitcoin ETF Unlikely to Get SEC Approval in January, Analyst Warns

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

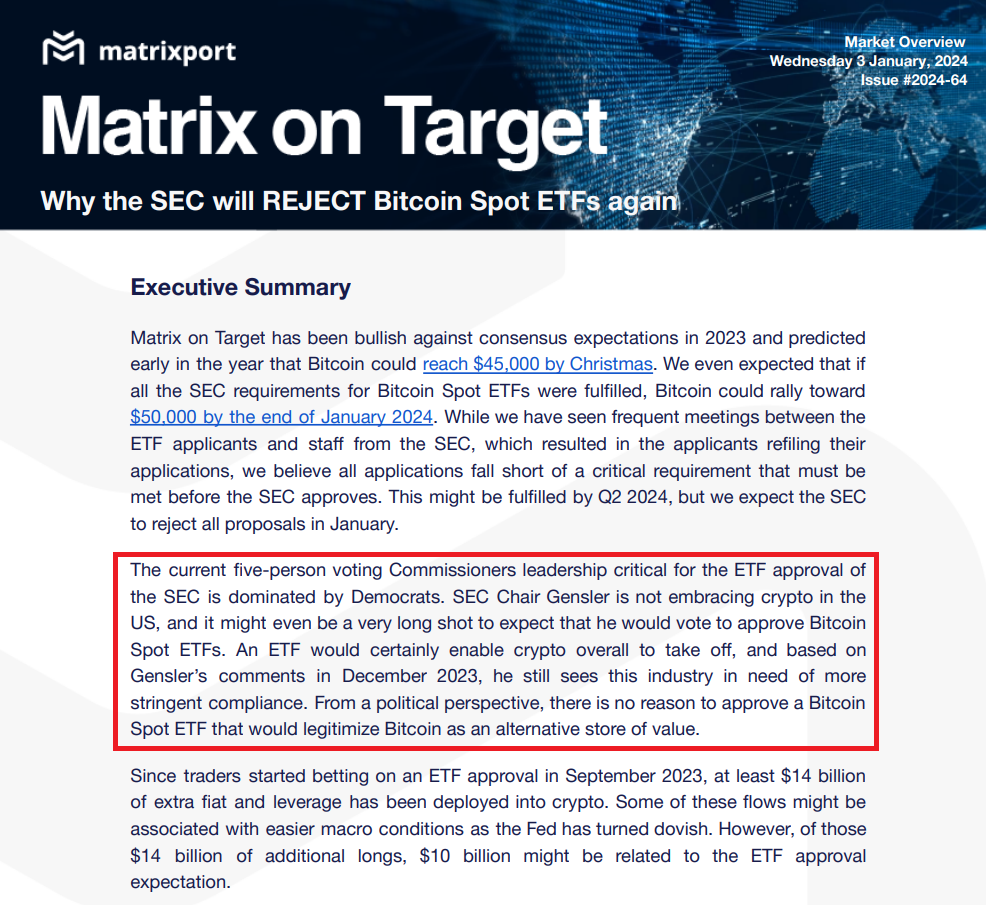

Matrixport analyst Markus Thielen predicts that the Securities and Exchange Commission (SEC) will reject all bitcoin spot exchange-traded fund (ETF) proposals in January.

Thielen’s contrarian view stems from his belief that SEC Chair Gary Gensler is not supportive of the crypto industry in the U.S. and is pushing for more industry compliance.

According to Thielen, the current proposals fail to meet a crucial requirement necessary for SEC approval. He anticipates that despite potential fulfillment by Q2 2024, the SEC is likely to reject all proposals as early as January.

A bitcoin spot ETF is designed to track the price of bitcoin, allowing investors to buy and sell shares of the fund on a stock exchange. This stands in contrast to a bitcoin futures ETF, which has already received SEC approval and tracks the price of bitcoin futures contracts.

14 Bitcoin ETF Proposals Are Awaiting Approval from the SEC

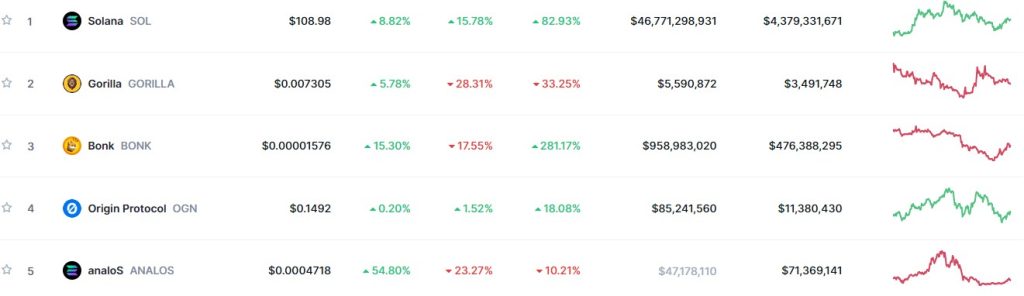

The crypto industry has long advocated for a bitcoin spot ETF, with 14 major asset managers, including BlackRock, Fidelity, Franklin Templeton, Valkyrie, and VanEck, having filed proposals with the SEC. The approval of such an ETF would make bitcoin more accessible and mainstream for investors.

However, Thielen cautions that a rejection by the SEC could trigger a significant sell-off in the crypto market. The liquidation of billions of dollars in long bitcoin futures positions might lead to a 20% drop in bitcoin’s price, potentially landing it in the $36,000–$38,000 range. Presently, bitcoin is trading at $43,000.

Despite short-term market volatility, Thielen maintains optimism about bitcoin’s long-term prospects. He predicts that bitcoin’s value will surpass its yearly starting point of $42,274 and rally towards $50,000 by the end of 2024, citing historical patterns of U.S. election years and bitcoin mining cycles.

This positive outlook provides a silver lining for long-term investors amid the regulatory uncertainties in the crypto space.