XRP Ledger Activity Declines in Q2 Amid Ripple vs. SEC Bout

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

According to a recent report by Messari, the XRP Ledger (XRPL) and other major Layer-1 (L1) networks experienced a decline in network activity during the second quarter of the year.

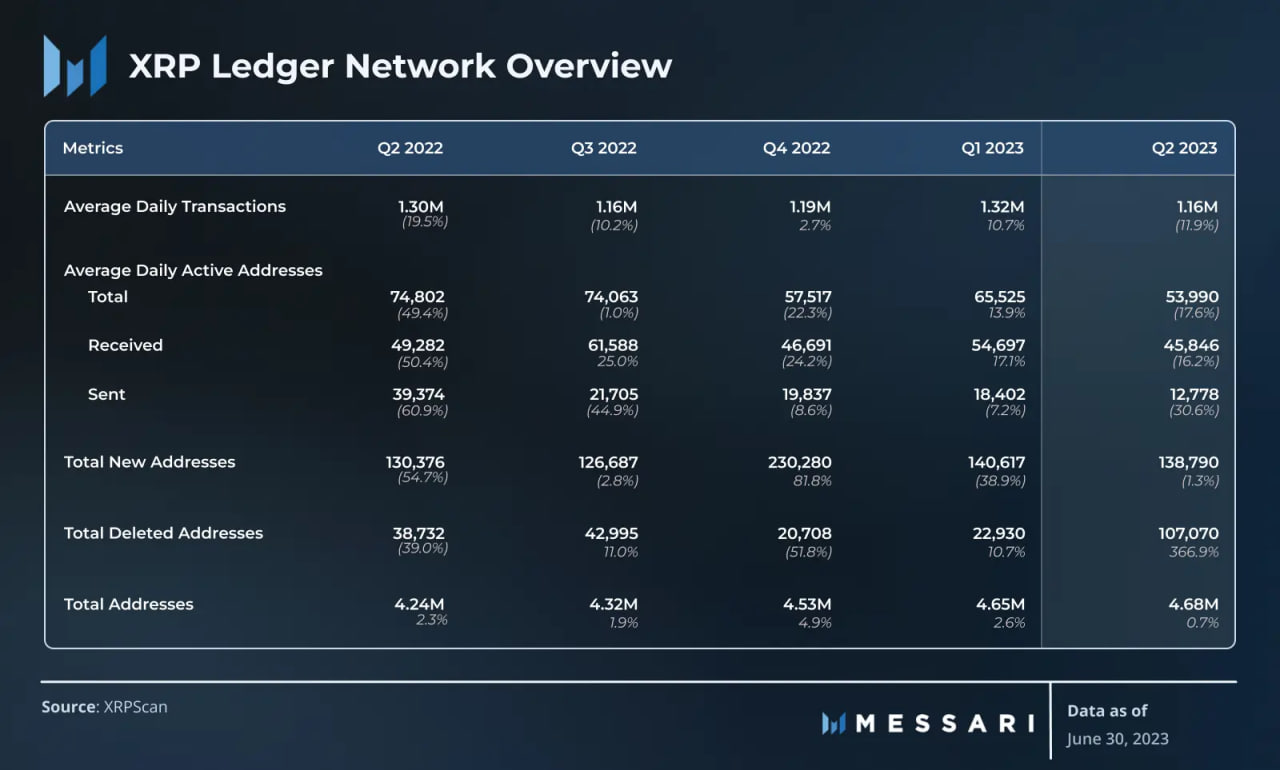

The average daily transactions on XRPL dropped by 11.9% quarter-over-quarter (QoQ) from 1.32 million to 1.16 million, returning to a level last seen in Q3 2022. Similarly, the average daily active addresses witnessed a significant decline, down 17.6% QoQ from 66,000 to 54,000, hitting a yearly low for Q2.

Despite the decline in network activity, there was a positive development in terms of the number of XRPL accounts. The report highlights an increase of approximately 30,000 accounts, driving the total number up by 0.7% to 4.68 million during Q2.

Furthermore, the number of new addresses remained relatively stable compared to the previous quarter, decreasing by 1.3% to 138,800. However, it’s worth noting that the number of deleted addresses experienced a significant surge, jumping by 366.9% QoQ from 22,900 to 107,100.

Active XRP Ledger Recipients Outpace Senders

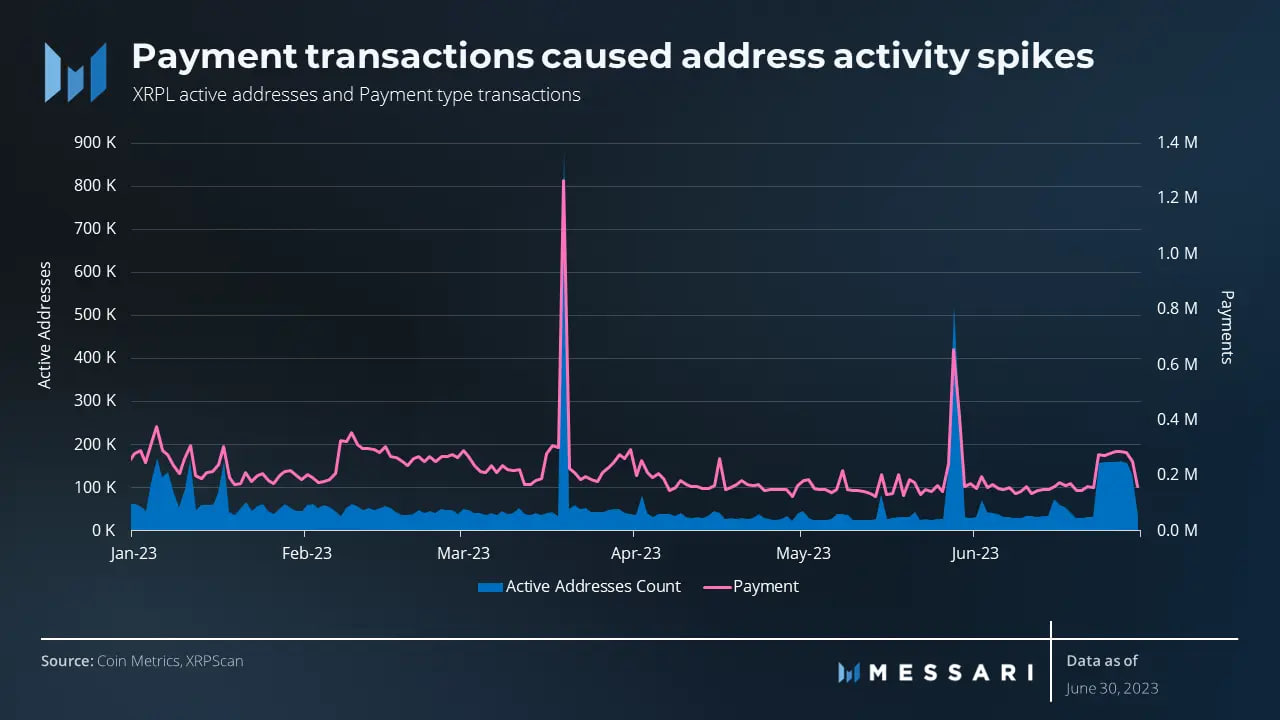

One interesting observation is the discrepancy between active recipient and sender addresses on XRPL.

The on-chain report suggests that centralized exchanges and custodians using destination tags and Payment transactions are responsible for this imbalance. These entities tend to generate a large number of active receiving addresses while being counted as a single or a few active sender addresses.

On May 28, 2023, approximately 523,000 addresses received transactions, marking the second-largest address activity day in the history of XRPL.

Impact of SEC Case and Revenue Spike

The Messari report suggests that recent price action in XRP may have been influenced by the news surrounding the ongoing SEC case with Ripple, which began in December 2020. It is important to note that correlation does not necessarily imply causation.

However, the substantial revenue spike in June coincided with significant developments in the SEC case and charges brought against Binance US and Coinbase. Although XRP was not implicated as a security in these cases, its implications for the broader cryptocurrency industry cannot be ignored.

You can purchase Lucky Block here. Buy LBLOCK