Bitcoin ETF Inflows Stall as BlackRock’s IBIT Faces Investor Exodus

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

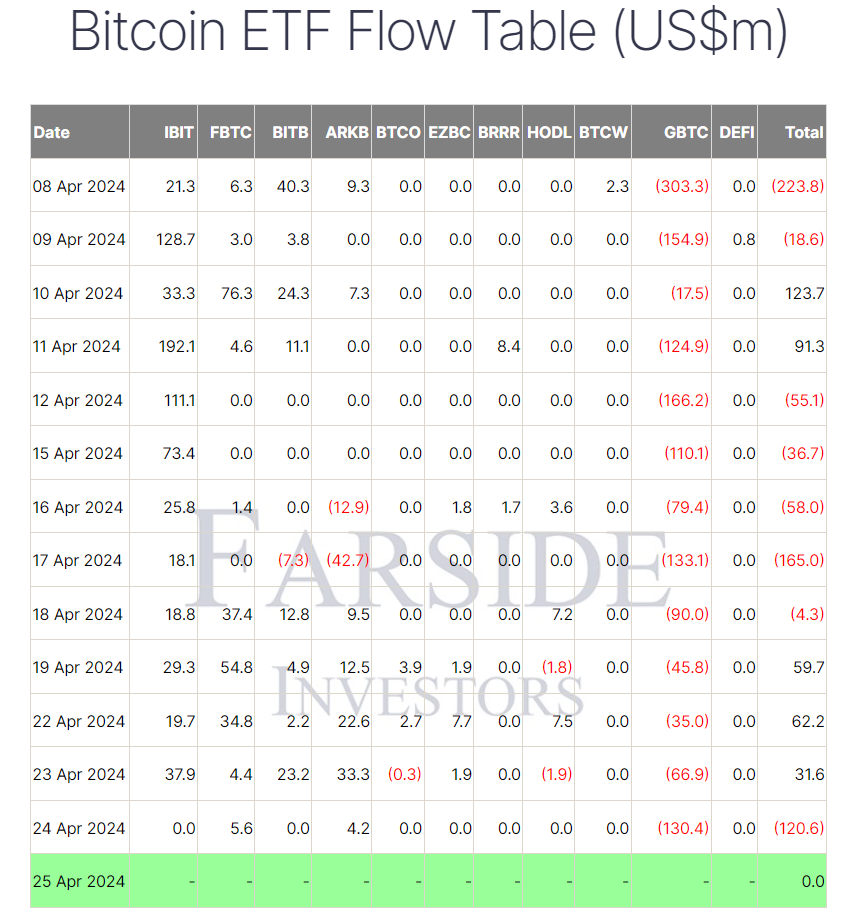

BlackRock’s spot bitcoin exchange-traded fund (ETF), known as IBIT, hit a roadblock on Wednesday as it failed to attract any new investor capital for the first time since its launch on January 11. The fund’s unexpected stagnation ended a 71-day streak of inflows, surprising many in the crypto investment community.

In contrast, Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF (ARKB) saw healthy inflows of $5.6 million and $4.2 million, respectively. However, the popular Grayscale Bitcoin Trust (GBTC) experienced significant outflows, losing $130.4 million. This downturn led to a cumulative net outflow of $120.6 million, the highest since April 17 ($165 million).

BlackRock’s Bitcoin ETF Records $15 Billion in Net Inflows

Spot ETFs made their much-anticipated debut in the U.S. on January 11, aiming to attract institutional money and revolutionize the crypto investment landscape. BlackRock’s IBIT, in particular, has been a standout performer, amassing over $15 billion in assets. Collectively, the eleven ETFs have seen a net inflow exceeding $12 billion.

Despite the initial enthusiasm, inflows have slowed considerably this month, with most of the activity occurring in the first quarter. The once-unstoppable Bitcoin bull run now faces headwinds, leaving investors pondering the next phase of the crypto market’s evolution.

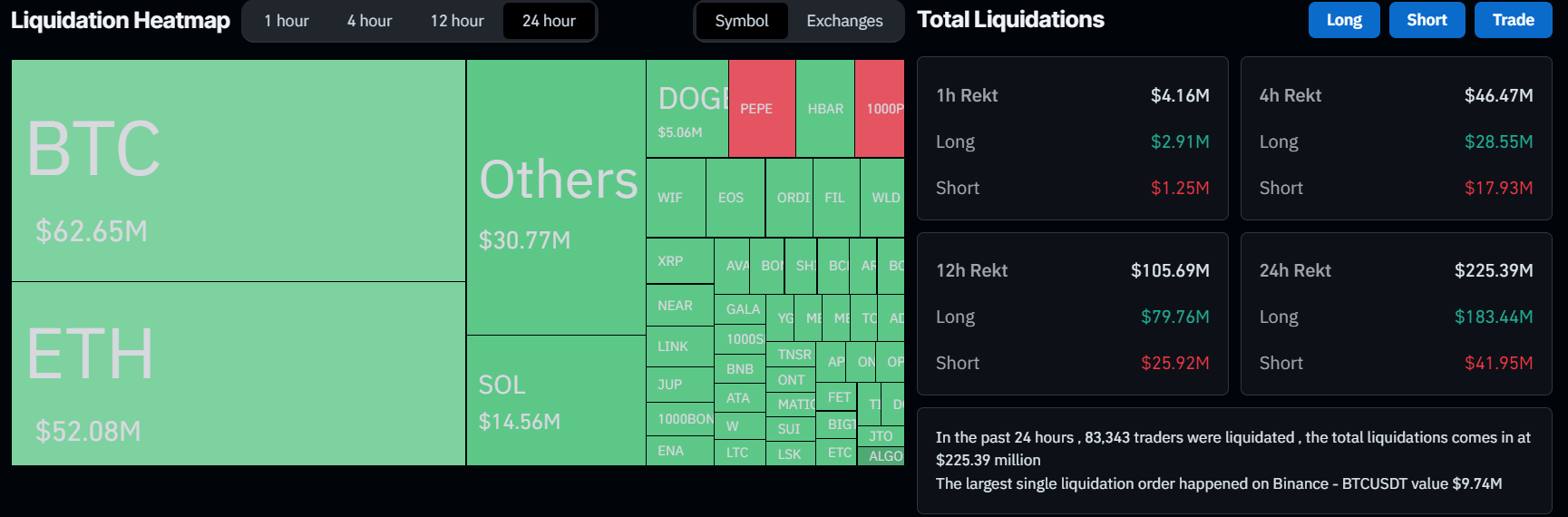

Bitcoin Dip Sparks Massive Liquidation

In other news, Bitcoin’s price surged above $66,000 for several days, briefly touching the $67,000 mark earlier this week. However, the cryptocurrency faced a sharp rejection, dashing bulls’ aspirations. Over 83,000 traders with long positions were liquidated, highlighting the market’s volatile nature. The total value of liquidations reached a staggering $225 million on the CoinGlass platform.

As the crypto landscape continues to evolve, investors and enthusiasts remain vigilant, closely monitoring developments in ETFs, prices, and market sentiment. With change on the horizon, the crypto community braces for what lies ahead.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here