BNB Price Drops, But Liquidity Remains Strong

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

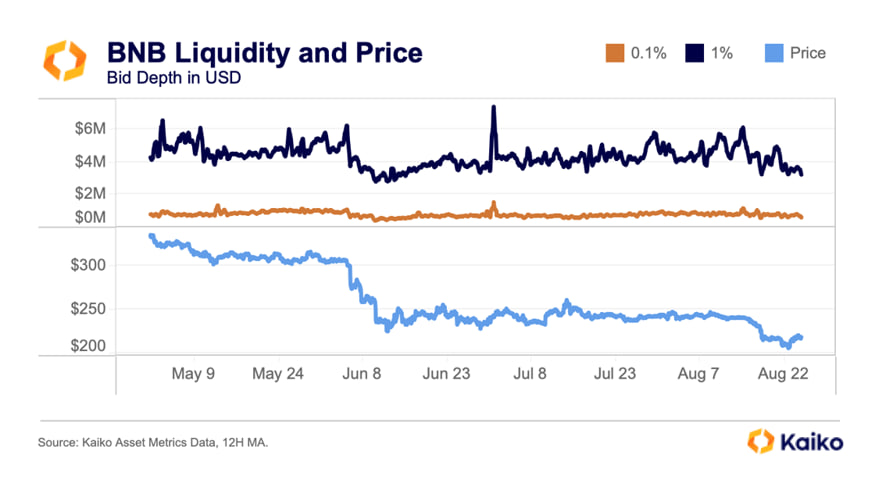

BNB, the native token of Binance, the world’s largest cryptocurrency exchange, has experienced a significant price drop in the past few months. From a high of $350 in April, BNB has fallen to around $218 as of August 28, 2023. However, despite the bearish trend, BNB has shown remarkable liquidity and bid support, according to a recent report by Kaiko, a leading provider of crypto market data.

Kaiko’s report reveals that BNB’s liquidity has not declined as much as its price. Liquidity measures how easily an asset can be bought or sold without affecting its price. Kaiko uses bid depth, which is the number of buy orders at a certain price level, to measure liquidity.

The report shows that BNB’s bid depth at both 0.1% and 1% levels has remained strong even as its price has dropped. This indicates that there is still a high demand for BNB among buyers.

However, the report also notes that about 90% of BNB’s liquidity is on Binance itself. This has led to some speculation that Binance is artificially supporting BNB’s price by selling other tokens. Kaiko states that it has not found any evidence of this, but it does raise some questions about BNB’s dependence on Binance.

BNB Derivatives Market Slowing Down

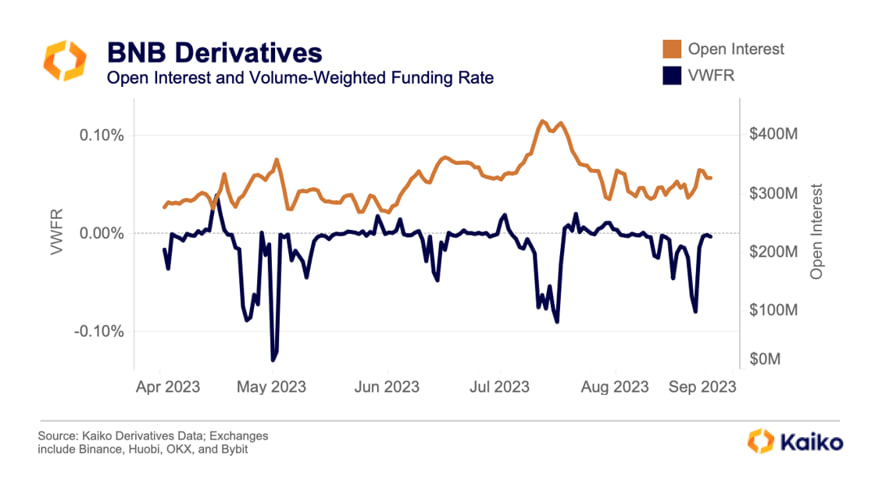

Another interesting finding from Kaiko’s report is that the derivatives market for BNB has cooled down recently. Derivatives are contracts that derive their value from an underlying asset, such as futures and options.

Kaiko uses open interest and volume-weighted funding rates (VWFR) to measure the activity and sentiment of derivatives traders. Open interest is the total value of outstanding contracts, while VWFR is the average fee paid by either longs or shorts to keep their positions open.

Kaiko’s report shows that open interest and VWFR for BNB peaked on July 11, 2023, when BNB was trading at around $240. This means that many traders opened short positions, betting that BNB’s price would go down further. However, since then, open interest and VWFR have flattened, indicating that traders have closed their positions or become less aggressive. This suggests that BNB has found some stability in the $200–220 range.

You can purchase Lucky Block here. Buy LBLOCK