Crypto Inflows Surge to Highest Levels Since July 2022: CoinShares

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Investor interest in digital assets is experiencing a resurgence, with a recent report from CoinShares revealing that crypto inflows reached a substantial $326 million last week, marking the highest inflow since July 2022. This notable surge in investment was primarily driven by growing expectations that the U.S. Securities and Exchange Commission (SEC) is on the verge of approving a spot-based Bitcoin ETF, which would represent a groundbreaking milestone for the crypto industry.

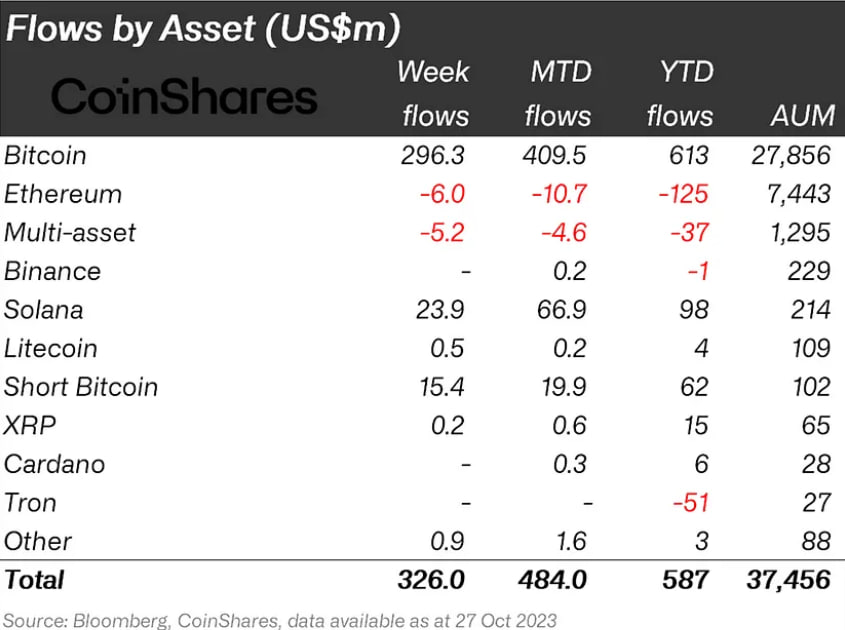

According to the report, Bitcoin dominated the inflow landscape, accounting for a significant 90% of the total, with an impressive $296 million flowing into Bitcoin-related investment products. Notably, some investors opted to bet against Bitcoin, as short-Bitcoin products saw inflows of $15 million. The rising price of Bitcoin also spurred heightened demand for alternative cryptocurrencies, including Solana, which attracted a substantial $24 million in inflows.

However, not all crypto assets benefited from the bullish sentiment. Ethereum, the second-largest cryptocurrency by market capitalization, experienced outflows of $6 million, signaling that investors are either securing profits or diversifying their portfolios.

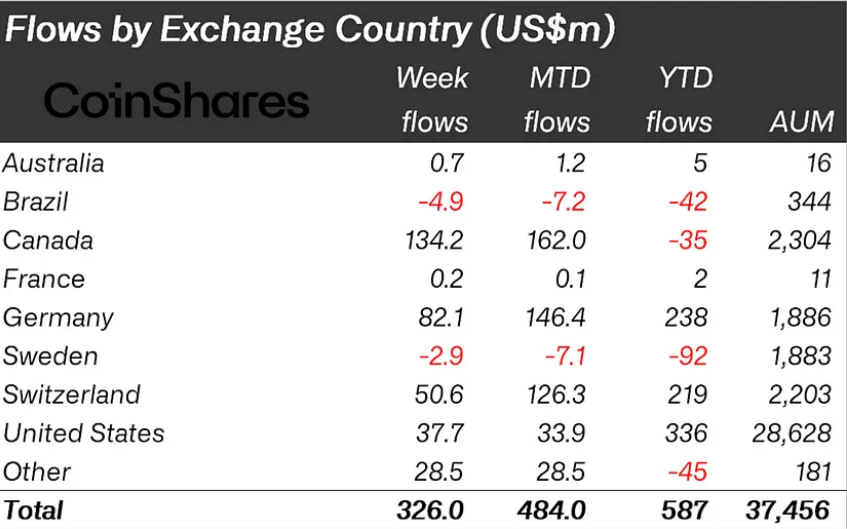

Canada Records the Highest Crypto Inflows

The report further highlights that crypto inflows were widely distributed across various regions and markets. Surprisingly, the U.S. market received only 12% of these inflows, totaling $38 million, as investors eagerly anticipate the SEC’s forthcoming decision on the spot-based ETF. The largest inflows originated from Canada, Germany, and Switzerland, amounting to $134 million, $82 million, and $50 million, respectively. Asia also witnessed a substantial increase in crypto inflows, totaling $28 million.

As a result of this heightened investor confidence, the total assets under management (AUM) of crypto investment products have now reached $37.8 billion, marking the highest level since May 2022. This significant uptick in AUM underscores the growing optimism surrounding the future of crypto assets and their potential to reshape the financial landscape.