Bitcoin Enters New Bull Cycle: Supply and Demand Dynamics in Focus

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin has surged over 100% in 2023, prompting speculation about the onset of a new bull cycle, according to a recent analysis by IntoTheBlock. The report delves into historical patterns and on-chain data to assess the likelihood of a Bitcoin bull market.

The Evolution of Bitcoin Cycles

The concept of Bitcoin cycles revolves around a four-year pattern of price expansion and contraction, marked by bull market peaks in 2013, 2017, and 2021. Central to this theory is the halving event, which occurs every four years and reduces the issuance of new Bitcoins to miners by 50%. Each previous halving has preceded significant price surges.

The supply side of BTC is influenced by its predetermined issuance schedule. With the latest halving in May 2020, Bitcoin’s inflation rate has dropped to just 1.8%, reducing the selling pressure from miners. As miner rewards decrease, their share of the total Bitcoin volume is expected to diminish.

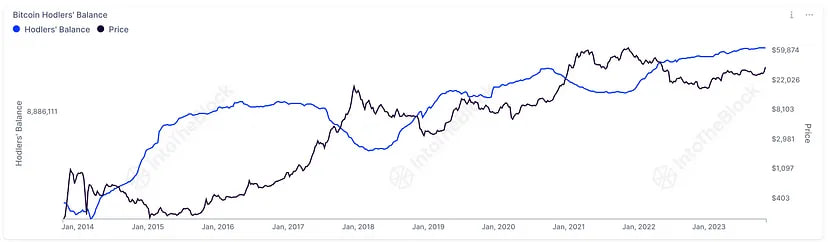

On the demand side, long-term investors, known as “hodlers,” play a crucial role in Bitcoin cycles. They historically accumulate during bear markets and gradually reduce their holdings as prices reach new highs. This conviction among hodlers reinforces Bitcoin’s store of value proposition.

The report also highlights the increasing participation of traditional finance institutions in the Bitcoin market, which could further drive demand. The potential introduction of a Bitcoin exchange-traded fund (ETF) and endorsements from influential figures like Larry Fink from BlackRock signify growing recognition of Bitcoin as a store of value.

One key metric for assessing Bitcoin cycles is the profitability of holders. The report mentions the Market Cap to Realized Value (MVRV) ratio, which historically signals market bottoms when it drops to 70%–80% and the beginning of bull markets when it surpasses 100%. Currently, Bitcoin’s MVRV ratio suggests that a new bull market may have started in early 2023.

Final Word

While historical patterns do not guarantee future returns, the alignment of positive supply and demand catalysts increases the likelihood of another bull cycle. The analysis by IntoTheBlock suggests that BTC may be in the early stages of a bull market, supporting the optimism of cryptocurrency enthusiasts.