PolygonLabs Slams Proposed SEC Rule Change

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a noteworthy development, Rebecca Rettig, the Chief Policy Officer at PolygonLabs, has come out strongly against a proposed rule change by the US Securities and Exchange Commission (SEC) that seeks to redefine the term ‘exchange.’ Rettig’s concerns stem from the potential unintended consequences this rule change could have on permissionless blockchain networks in the US and the burgeoning decentralized finance (DeFi) ecosystem.

Rettig makes a compelling argument, shedding light on the crucial misunderstanding embedded in the proposed rule. She points out that the rule suggests validators, independent entities responsible for verifying transactions on blockchain networks, should register as ‘exchanges.’ However, Rettig aptly explains that this requirement is impractical since validators lack control over DeFi protocols and do not coordinate actions in the manner expected of traditional ‘exchanges.’

🚨 Today @0xPolygonLabs submitted a response to the @SECGov‘s proposed rulemaking redefining the term “exchange”. The new proposed rule isn’t only harmful for DeFi — it threatens the very existence of permissionless blockchain networks in the U.S. https://t.co/Yh6xp2e6fG pic.twitter.com/xwPNxA70kn

— Rebecca Rettig (@RebeccaRettig1) June 13, 2023

PolygonLabs Faults SEC for Implicit Bias and Uneven Standards in Regulation

Drawing attention to another significant issue, Rettig highlights the implicit bias inherent in the proposed rule. She emphasizes that the rule places blockchain technology under a different and stricter standard compared to cloud-based applications. While cloud-based services only necessitate registration by the deployer, the proposed rule could potentially force every participant in the blockchain ecosystem, including individual validators, to register, creating an unfair and burdensome regulatory framework.

PolygonLabs expresses profound concern over the potential ramifications of this rule, cautioning that it may effectively result in a de facto ban on the vibrant and innovative permissionless blockchain industry in the US. Such a ban would have far-reaching consequences, stifling innovation and hindering the development of software protocols like DeFi that heavily rely on these networks. It underscores the urgent need for well-crafted regulations that strike a balance between protecting investors and fostering the transformative potential of blockchain technology.

Investor Behavior and Regulatory Influence

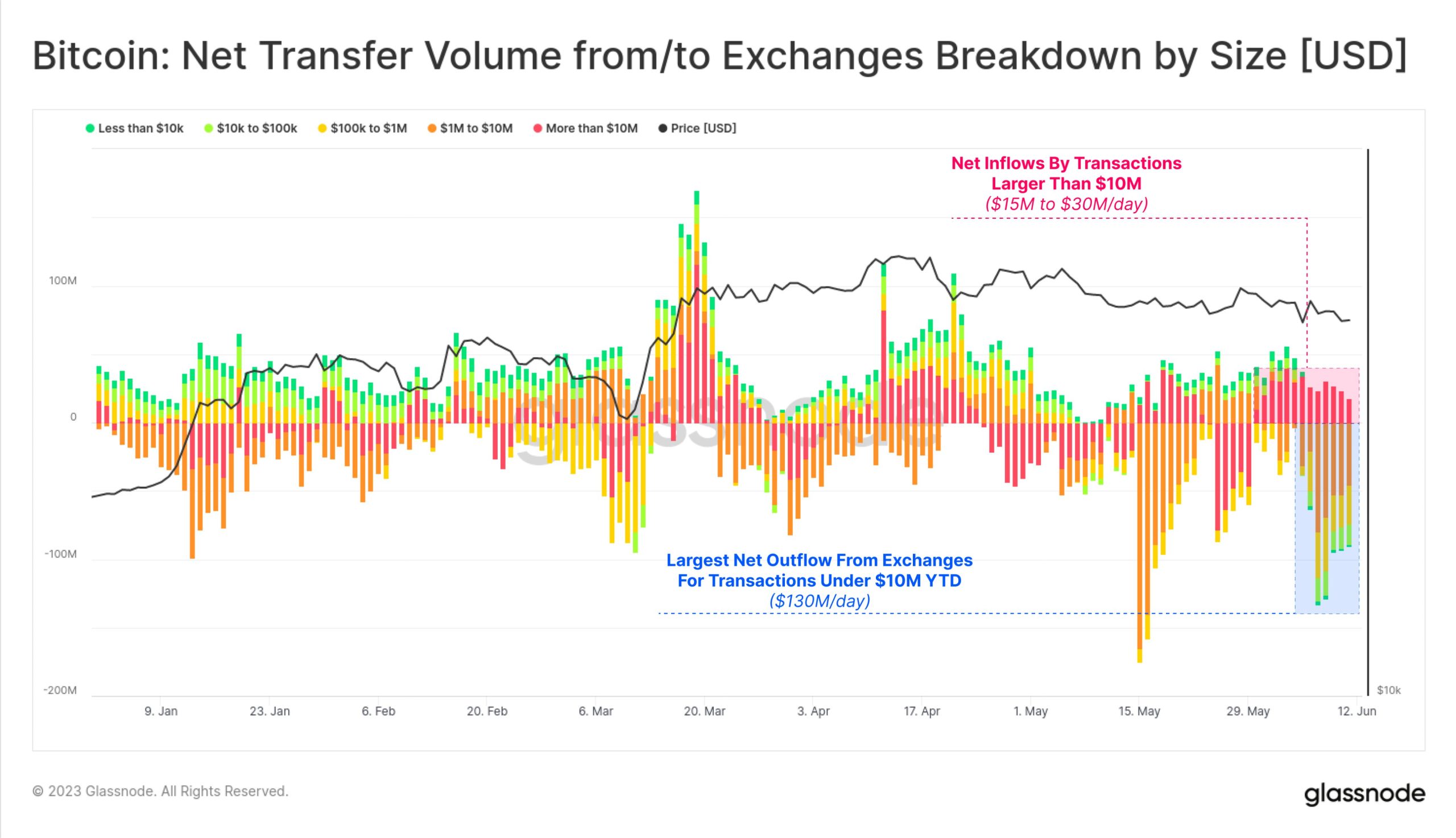

In related news, recent data from Glassnode, a leading blockchain analytics platform, reveals a significant divergence in investor behavior that may be influenced by these regulatory developments. Notably, transactions below $10 million consistently experience withdrawals, resulting in a daily net outflow surpassing $130 million over the past week. On the contrary, transactions exceeding $10 million exhibit steady deposits, with daily inflows ranging between $15 million and $30 million.

You can purchase Lucky Block here. Buy LBLOCK