Tether Emerges Victorious as USDC Struggles Amid Crypto Crackdown

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Amid America’s ongoing war on crypto, the stablecoin ecosystem has experienced a seismic shift, revealing a clear divergence between the top two issuers. Tether, the indisputable leader of the stablecoin market, has recently reached an all-time high supply of 83.36 billion USDT, a feat proudly announced in the firm’s transparency report. Meanwhile, Circle’s USDC, once the darling of institutional investors, is facing dwindling demand due to the industry-wide crackdown.

Tether in circulation just reached an ATH of $83.35 billion

The divergence from USDC is striking, reflecting easier access to treasuries for US-based USDC holders & regulatory uncertainty for US-based Circle. What was once a competitive advantage for USDC is now the opposite. pic.twitter.com/OcExkpZqAW

— Will Clemente (@WClementeIII) June 11, 2023

Circle, a prominent player in the stablecoin realm, has been dealt a heavy blow due to its exposure to the now-bankrupt Silicon Valley Bank. This unfortunate connection led to USDC being de-pegged in early March, leaving investors in disarray.

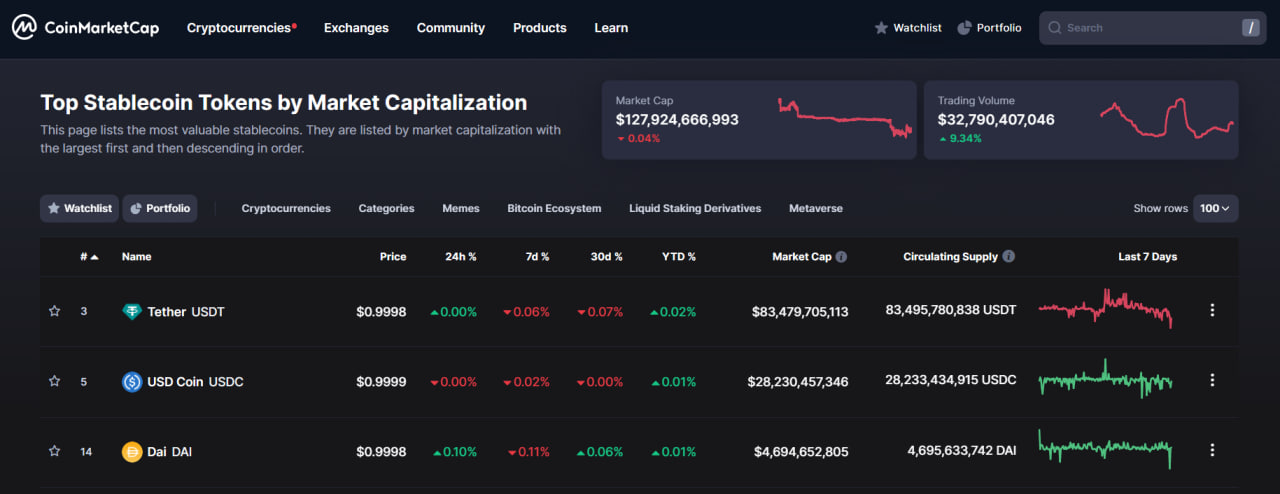

Since that fateful event, USDC’s supply has plummeted by a staggering 50%, tumbling from its peak of around $56 billion in June 2022. Consequently, its market share has taken a beating, now languishing at a meager 22%. In stark contrast, Tether has risen to an unparalleled commanding position, commanding an impressive 64.5% of the stablecoin market.

CoinMarketCap’s latest data reveals that the total stablecoin market capitalization currently stands at a formidable $128 billion, representing a substantial 12.2% slice of the entire cryptocurrency market. However, it’s important to note that this market segment has faced considerable shrinkage during the bear market, leaving stakeholders on edge.

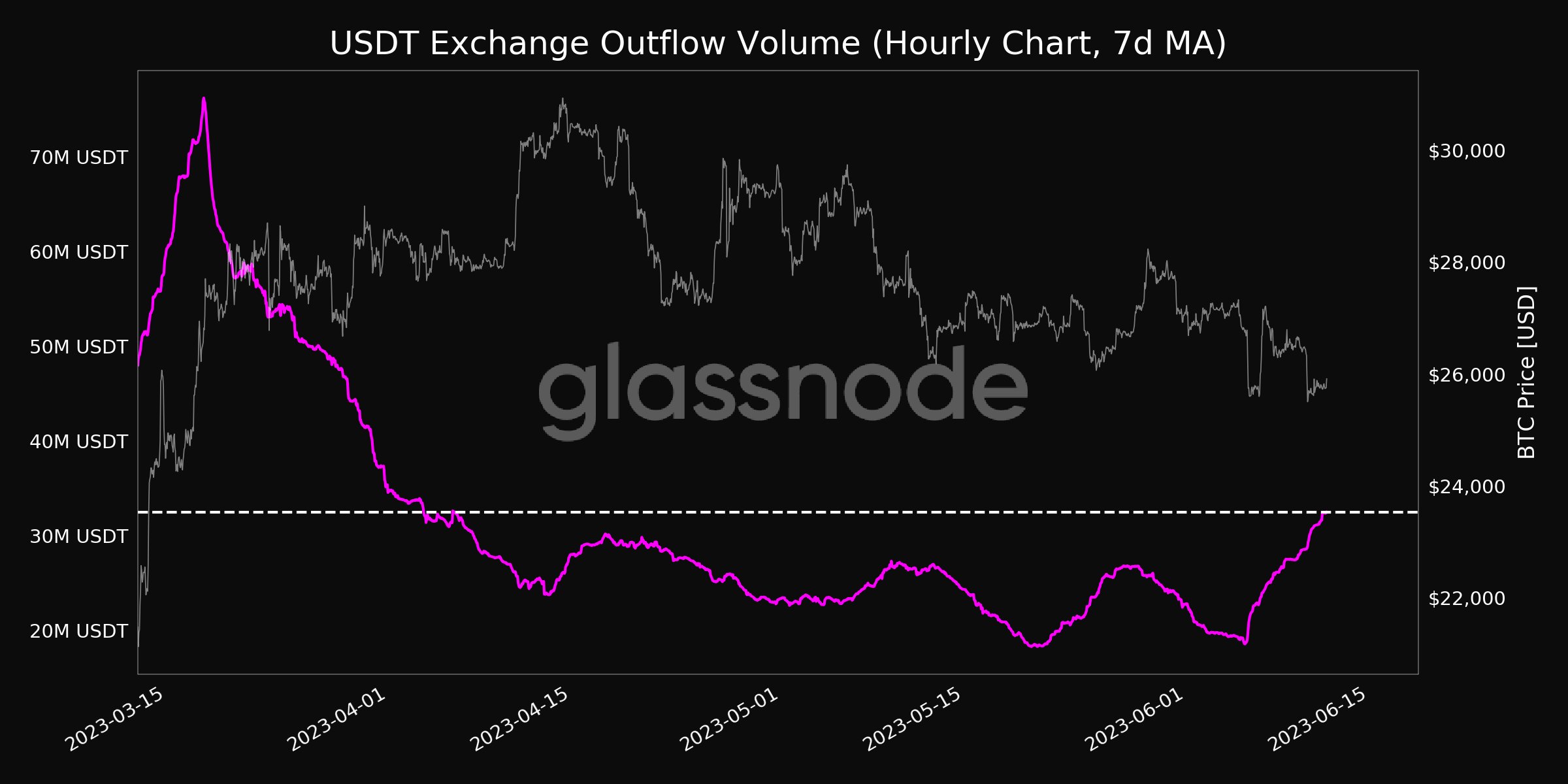

Glassnode Reveals Outflow of Tether and USD Coin from Centralized Exchanges

Glassnode, a prominent analytics platform, recently published a report on June 12 shedding light on the exodus of USDT and USDC from centralized exchanges. Both stablecoins hit a monthly high for outflow volumes, indicating a growing flight to safety among traders and investors, particularly from platforms like Binance. This heightened sense of caution has been fueled by the recent barrage of lawsuits and enforcement actions from the Securities and Exchange Commission (SEC).

Nonetheless, Binance CEO Changpeng Zhao has urged investors not to read too much into Binance outflow figures from analytics platforms. CZ cautioned against placing excessive weight on these numbers, as they often include decreases in crypto asset prices as measured by the total value locked (TVL).

You can purchase Lucky Block here. Buy LBLOCK