Crypto Luck: Friday the 13th Holds No Fears for Hodlers!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Greetings, resilient HODLers, on this supposedly ominous Friday, the 13th!

While it may seem unconventional to extend cheerful wishes on what’s deemed the unluckiest of days, we, as crypto enthusiasts, don’t base our sentiments on superstition. There are compelling reasons for crypto investors to defy the prevailing superstitions and wear a smile.

Join us as we unravel tales, debunk superstitions, and explore how Bitcoin has historically defied the stigma of Friday the 13th. This exploration aims to calm the nerves of those uneasy about today’s date.

Was Friday the 13th Always Jinxed?

Delving into history, the oldest recorded negative reference to the number 13 is discovered in the Mesopotamian Code of Hammurabi, a Babylonian legal code dating back to around 1760 BC. Strikingly, the laws are numbered, yet the number 13 is conspicuously absent.

Individuals who harbor a fear of the number 13 are known as triskaidekaphobics. Notably, acclaimed horror novelist Stephen King and the 32nd president, Franklin D. Roosevelt, are among the ranks of famous triskaidekaphobics.

The association of ill luck with Fridays falling on the 13th gained traction from a historical event in the 14th century. On Friday, October 13, 1307, King Philip IV of France orchestrated the arrest of the Knights Templar, leading to the torture and demise of many knights. Today, let’s break free from superstitions and find fortune in our crypto pursuits.

There’s even a name for those scared of Friday the 13th: paraskevidekatriaphobia.

Decoding the Crypto Conundrum: What Friday, the 13th, Holds for Crypto Enthusiasts

In the realm of crypto holdings, the dichotomy of good and bad, lucky and unlucky, unfolds with intriguing nuances. Unless your portfolio is grappling with challenges, the significance of Friday, the 13th, may not hold much sway. Surprisingly, this seemingly ominous day has historically cast a positive glow on stocks. Since its inception, the S&P 500 has exhibited an average gain of 0.1% on Friday, the 13th, a noteworthy triple-fold increase compared to the average gain of 0.03% on all trading days.

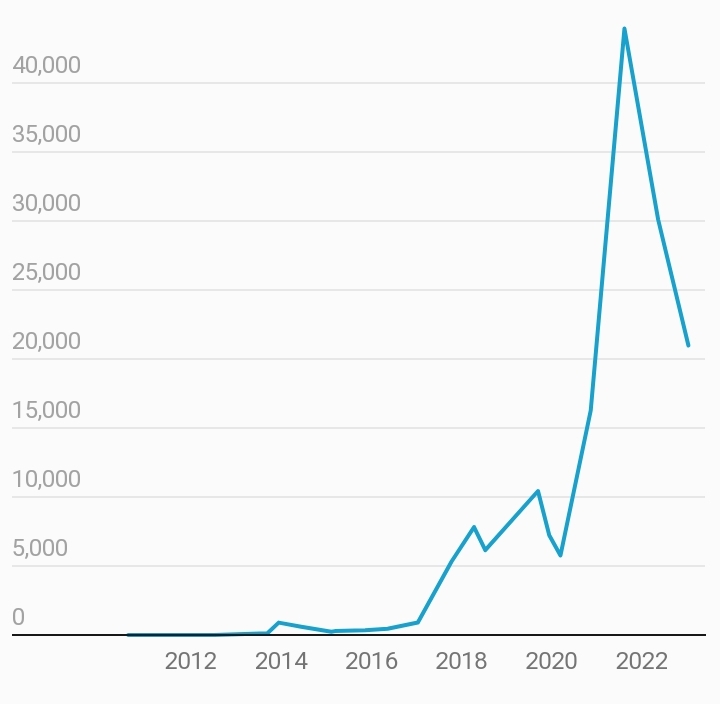

While bitcoin boasts a comparatively shorter history, its resilience and positive performance on Friday, the 13th, defy the superstitions and historical events associated with the date. Data reveals that since 2010, bitcoin has, on average, experienced a 1% rise on this purportedly unlucky day, with subsequent notable surges in the following one and three months. This remarkable feat stands out as a 10-fold increase compared to the average gains observed in stock markets on Friday, the 13th.

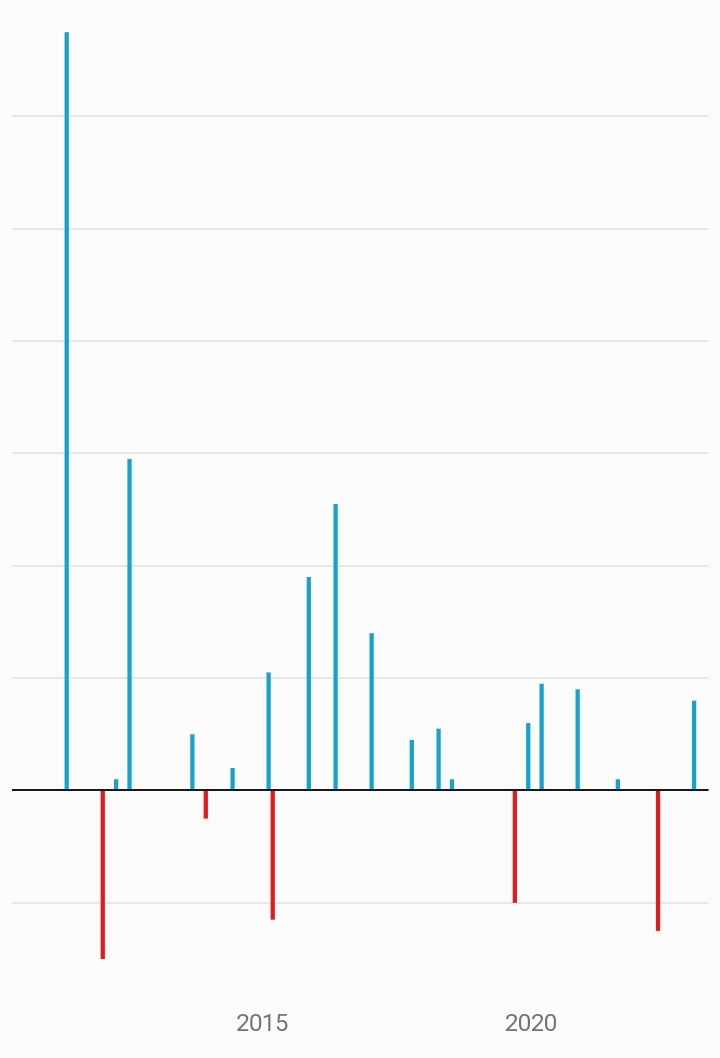

Exploring the historical trajectory of Bitcoin prices on Friday, the 13th, from 2010 to 2023 unveils a fascinating narrative. Delving into the 1-month results provides even more telling insights. On average, Bitcoin yields a remarkable 14% return in the month following Friday, the 13th. Comparatively, scrutinizing the monthly returns for the S&P 500 dating back to 1900 reveals only three instances where monthly returns surpassed the 14% mark. Interestingly, one must journey back to 1938 to find the last time the S&P 500 recorded a monthly return exceeding 14%. As crypto enthusiasts navigate the complexities of the market, Friday the 13th could very well be a harbinger of fortune in their digital pursuits.

April 1933 – 29.3%

May 1933 – 17.6%

June 1938 – 20.5%

Unveiling the Saga: Bitcoin’s 1-Month Returns on Friday, the 13th (2010–2023)

While the landscape of three-month returns remains uncharted, rest assured that the S&P 500 has never witnessed a staggering 66% surge in such a brief period.

Digging deeper into the details, nuances emerge as certain months outshine or falter compared to others. Notably, October stands out with the dubious honor of hosting the S&P 500’s two lowest daily returns on Friday, the 13th. The darkest day for stocks unfolded on October 13, 1989, witnessing a dismal loss of 6.1%, closely followed by the 3.8% drop on Friday, October 13, 1933. In a contrasting narrative, bitcoin’s Friday the 13th experiences in October have been consistently positive, albeit with a limited dataset—a noteworthy 6% gain was recorded on Friday, October 13, 2017.

Conclusion

In the realm of rational investment, superstitions seldom find a place in our assessments. We are not mere gamblers relying on chance; instead, we anchor our strategies in knowledge, patience, and meticulous research. Armed with accurate information and keen insights, crypto investment becomes a pursuit detached from the vagaries of specific calendar dates.

For crypto investors, the future holds promise. While the available data might not yet render Bitcoin’s historical outperformance statistically significant, the trend is undeniable: bitcoin consistently outpaces stocks. This aligns seamlessly with other historical benchmarks comparing the trajectory of Bitcoin and stocks. As we navigate the unpredictable seas of the market, it’s informed decisions and strategic moves that steer the course, irrespective of the day on the calendar.