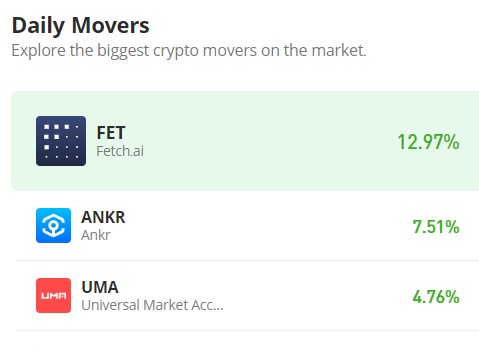

Fetch.ai (FET/USD) Finally Surges Above the $3.00 Price Level

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The price point of $3.00 has consistently served as a pivotal level for profit-taking in the Fetch.ai market. During the recent bullish trend, this threshold marked the peak, prompting significant profit-taking activities. Subsequently, the ensuing bearish market encountered resilient bullish sentiment, constraining its movement within the price range of $2.40 to $3.00. Notably, since March 10th, the market has exhibited sideways movement within this range until today, when renewed bullish interest propelled the price above the crucial $3.00 threshold.

Fetch.ai Market Data

- FET/USD Price Now: $3.282

- FET/USD Market Cap: $2.7 billion

- FET/USD Circulating Supply: 840 million

- FET/USD Total Supply: 1.2 billion

- FET/USD CoinMarketCap Ranking: #50

Key Levels

- Resistance: $3.50, $4.00, and $4.50.

- Support: $2.50, $2.00, and $1.50.

Fetch.ai Market Analysis: The Indicators’ Point of View

For the past 15 days, the Fetch.ai market has undergone a consolidation phase, culminating today in a significant shift as bullish momentum surged, driving the market above a key resistance level that has persisted as a barrier since March 10th. This current bullish momentum appears potentially sustainable, as evidenced by the prevailing dominance of bulls in today’s trading session, which has led to an increase in volatility as indicated by diverging Bollinger Bands. According to this crypto signal, Bulls could leverage this heightened volatility to further propel the price upward. Moreover, considering the longstanding resistance at $3.00, a breakthrough at this level could catalyze additional bullish sentiment, potentially setting the market on a trajectory towards the $4.00 price level.

FET/USD 4-Hour Chart Outlook

Before considering a potential resistance at the $4.00 mark, the 4-hour chart outlook highlights the $3.50 price level as a proximate resistance level. Given the current high volatility in the market, bears may emerge as a significant force at the $3.50 price level. Thus, a nearby support level to sustain the bull run’s momentum towards $3.50 is crucial. As mentioned earlier, the breach of the long-standing $3.00 price level could incentivize additional traders to join the bullish trend, thereby maintaining momentum towards the $4.00 milestone.