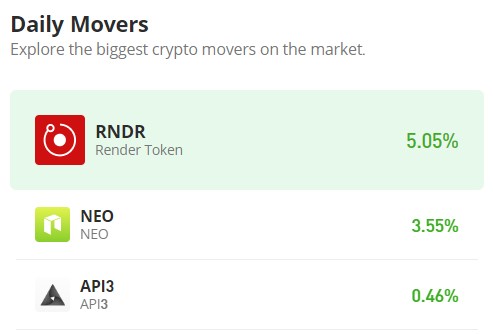

Neo Market (NEO/USD) Maintains a 3.7% Bullish Stance Despite Ongoing Bearish Pressures This Week

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Despite a few sporadic spikes in trading volume, the Ne0 market has experienced consistently low trading activity since approximately mid-2023. Towards the end of the year, there was a notable increase in trading, resulting in a price surge from $7.0216 on October 20 to a peak of $14.563. This level has proven to be a resilient resistance since late last year. The bulls have also established the $10.000 price level as a support threshold.

Presently, the market is facing bearish pressure; however, the bulls have managed to maintain a 3.7% position for the current week, demonstrating a commitment to prevent the market from depreciating beyond this level.

The Neo Market Data

- NEO/USD Price Now: $11.247

- NEO/USD Market Cap: $784 Million

- NEO/USD Circulating Supply: 70,538,831 NEO

- NEO/USD Total Supply: 100,000,000

- NEO/USD CoinMarketCap Ranking: #85

Key Levels

- Resistance: $12.00, $12.50, and $14.00.

- Support: $10.00, $9.00, and $8.00.

The Neo Market Crypto Signal: Analyzing the Indicators

The indicators suggest a bearish trend in the Neo market. According to the Bollinger Bands indicator, not only is there a downward trajectory in the bands, indicative of a descending price channel, but the price action itself is also below the 20-day moving average. Additionally, the Relative Strength Index reflects market momentum below the 50 level, signaling a prevailing bearish sentiment.

While attempts by bulls to maintain a 3.7% position indicate potential momentum on their part, concerns arise due to the relatively small volume of trade histogram. This raises questions about the sustainability of the ongoing bullish price movement. Nevertheless, if bulls can sustain their current position, the market may find equilibrium, potentially establishing a robust support level conducive to further upward price action. Monitoring the volume of trade remains crucial in assessing the strength of the bullish stance and the potential for a sustained market shift.

NEO/USD 4-Hour Chart Outlook

Analyzing the market from a 4-hour chart perspective, it becomes evident that the Neo market experienced robust bullish price movement in the preceding daily market session. However, this upward momentum proved to be unsustainable, and repeated rejections may have reinforced the bearish sentiment, posing challenges for the recovery of the bull market.

Presently, the price is at equilibrium, and the possibility of either a support or resistance level emerging will play a pivotal role in determining the market’s next direction. This critical crypto signal suggests that careful monitoring is necessary to assess whether the market will establish a resilient support level or encounter further resistance, influencing its trajectory.