Beyond Hype: Crypto’s Evolution from Speculation to Fundamental Growth

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

There is the notion that cryptocurrencies will evolve into robust onchain enterprises characterized by defined business frameworks, consistent cash flows, and enduring economic value. Envisioning a future where crypto, encompassing public blockchains and the associated protocols and ventures, becomes a globally recognized asset class, we anticipate its integration into a myriad of internet-centric business paradigms. As this transformation unfolds, we foresee a transition from speculative and narrative-driven investments to a focus on intrinsic value and foundational principles. The emerging indicators affirming this shift are becoming increasingly palpable. In this week’s briefing, we delve into pivotal developments related to onchain metrics, crypto fundamentals, and innovative financial instruments emerging in the crypto landscape.

A Brief History of Value Investing

The evolution of value investing is a testament to the intricate interplay of societal advancements and financial innovations. Today’s global equities landscape, boasting a staggering value nearing $110 trillion—with the U.S. contributing approximately $45 trillion—reflects the culmination of centuries of development.

The genesis traces back to 1602 with the Dutch East India Company’s inception, marking the world’s pioneering publicly traded enterprise. This milestone birthed the Amsterdam Stock Exchange, heralding the dawn of organized stock trading. Subsequent centuries witnessed the proliferation of stock markets in pivotal European hubs like London and Paris during the 1800s. Meanwhile, the U.S., spurred by the Industrial Revolution, experienced a surge in speculative fervor, notably around railroad stocks, catalyzed by the establishment of the New York Stock Exchange.

By the turn of the 20th century, stock markets had ingrained themselves as linchpins of the global economic framework. However, unchecked speculation, compounded by information asymmetry, precipitated the devastating stock market crash of 1929, ushering in the Great Depression.

Addressing the information disparity, public blockchains present a transformative solution. Entities like Token Terminal are leveraging this technology to provide invaluable insights to crypto enterprises, investors, and oversight bodies. For instance, real-time data can elucidate the evolving leverage dynamics within the crypto realm, offering a vital instrument for regulatory oversight.

In the aftermath of the Depression-era market upheaval, a wave of regulatory reforms swept across global financial hubs. Notably, the U.S. instituted pivotal legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, concurrently establishing the Securities and Exchange Commission (SEC) to safeguard financial integrity.

Amidst this regulatory backdrop, Benjamin Graham penned his seminal work, “Security Analysis,” elucidating the principles of fundamental analysis and the concept of intrinsic value.

The transformative potential of Graham‘s principles was later exemplified by Warren Buffet in the ensuing decades, notably during his stewardship of Berkshire Hathaway. As the appeal of value investing burgeoned throughout the latter half of the 20th century, financial discourse gravitated towards established metrics: from price to earnings, price to book, and dividend yield to debt to equity, free cash flow, return on equity, and net margins.

Concurrently, the investment lexicon expanded to incorporate nuanced concepts like “economic moats” and “durable competitive advantages,” underscoring the enduring merits of certain enterprises.

Central to this evolution was the ascendancy of reliable data. Absent accurate data, markets risked being swayed by unfounded speculation, prevailing narratives, or mere brand perception.

Transitioning to the realm of cryptocurrencies, it’s evident that the nascent market has predominantly pivoted on speculative sentiment and prevailing narratives. However, the winds of change are palpable. As crypto matures, so do its foundational fundamentals, heralding a new era where data-driven insights complement traditional market dynamics.

Digital Financial Statements

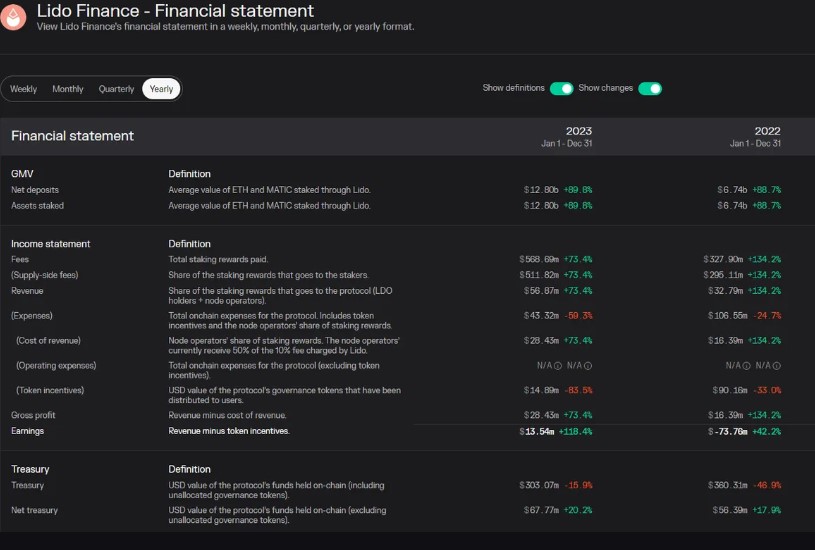

Platforms such as Token Terminal have ushered in a new era for crypto, offering financial insights akin to traditional statements. However, distinctively, this data is dynamically updated in near real-time, sourced from immutable public blockchains.

Displayed below are the financial metrics for Lido, Ethereum’s premier liquid staking solution, spanning recent years:

We can carry out a relative analysis.

We have the capability to make comparative assessments spanning various projects, sectors, and blockchains. Presented below are the leading Ethereum Layer 2 solutions, categorized by fees, revenue, operational costs, cost of revenue, token incentives, and net earnings.

Understanding the Relationship Between Innovation and Speculation

Throughout history, speculation has been the catalyst for groundbreaking innovations, from the steel and electricity eras to automobiles and telecommunications. This speculative drive paves the way for capital to discover its optimal use, leading to sustainable business models, established infrastructure, and regulatory frameworks. Today’s emergence of blockchain technology and Web3 exemplifies this trend, embedding a novel data layer into the internet with shared accounting ledgers and digital property rights. As foundational structures solidify and technology scales, we witness the genesis of new investment fundamentals, analytical tools, and innovative financial products.