Crypto Inflows Continue for Eight Weeks in a Row, Crossing $1.3Bn

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In a sustained bullish trend, the cryptocurrency market has welcomed steady crypto inflows for the eighth consecutive week, according to CoinShares, a prominent digital asset investment firm.

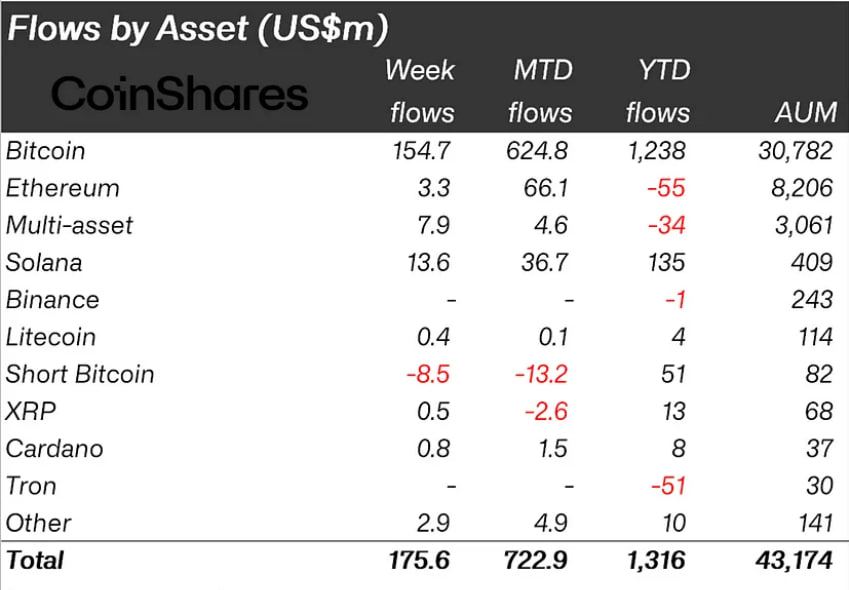

The latest data reveals that the past week alone witnessed a robust $176 million flowing into crypto investment products, propelling the total inflows for the year to an impressive $1.32 billion. Despite this encouraging surge, it falls short of the towering figures witnessed in 2020 and 2021, which peaked at $6.6 billion and $10.7 billion, respectively.

Bitcoin ETF Approval Expectations in the US Influencing Crypto Inflow

A notable highlight in the report is the remarkable surge in trading volumes for crypto exchange-traded products (ETPs), averaging $3 billion weekly, surpassing the yearly average of $1.5 billion. ETPs now constitute 11% of the total crypto volumes, a significant uptick from the historical average of 3.4%.

This positive sentiment is attributed to the anticipation surrounding the potential approval of a spot-based Bitcoin ETF in the US. Analysts believe this could spark heightened demand and positively impact the price of the leading cryptocurrency. Bitcoin dominated last week’s inflows, securing $155 million, constituting 3.4% of its total assets under management. Conversely, short-Bitcoin products experienced outflows of $8.5 million.

Among altcoins, Solana, Ethereum, and Avalanche emerged as the frontrunners, attracting $13.6 million, $3.3 million, and $1.8 million in inflows, respectively. Meanwhile, Uniswap and Polygon witnessed minor outflows of $0.55 million and $0.86 million, respectively.

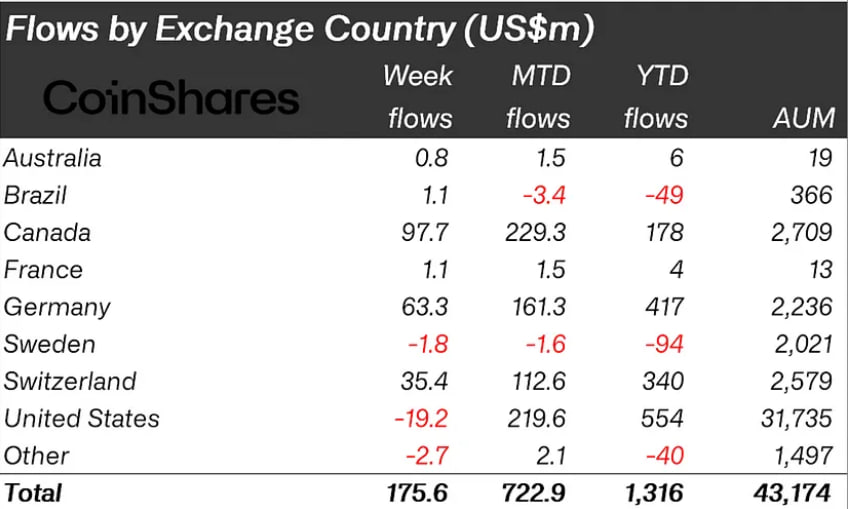

The report also sheds light on regional disparities, with Canada, Germany, and Switzerland leading the influx at $98 million, $63 million, and $35 million, respectively. However, the US experienced outflows from futures-based products, totaling $19 million.

Crypto Market Starts the Week Static

As of the latest update, the crypto market is trading at neutral levels, with Bitcoin and Ethereum showing minimal price action to kick off the week. Investors are keenly watching the evolving dynamics and activities in anticipation of further developments in the market.