Crypto Outflows Hit $500 Million as Investors Seek New Opportunities

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

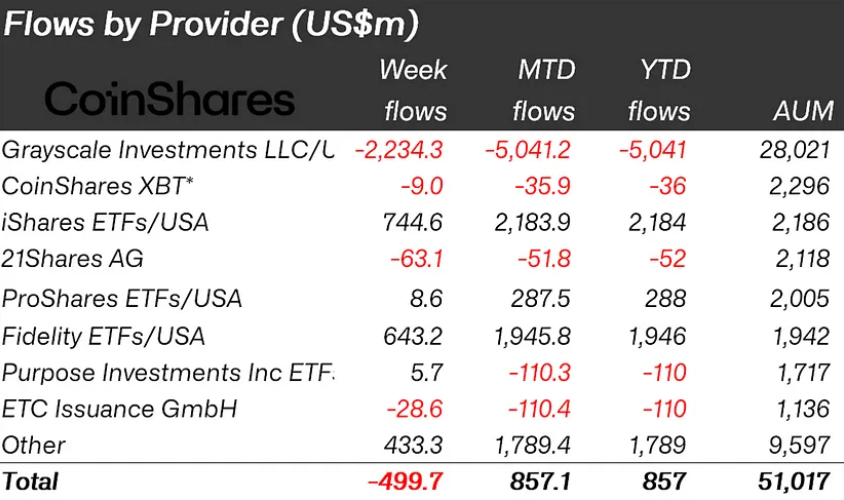

The global market for digital asset investment products witnessed a massive wave of outflows last week, amounting to $500 million, according to CoinShares’ latest report. The crypto outflows were mainly concentrated in the US, Switzerland, and Germany, where investors withdrew $409 million, $60 million, and $32 million, respectively, from various crypto funds.

The report attributed the outflows to the recent price drops in the crypto market, which were partly driven by the large-scale redemptions from Grayscale, the leading ETF issuer in the US.

Grayscale has seen its assets under management shrink by $5 billion since January 11, 2024, when the first US Bitcoin ETF was launched. Last week alone, Grayscale experienced $2.2 billion in outflows, although the report noted that the pace of outflows was slowing down.

On the other hand, the new US Bitcoin ETFs attracted $1.8 billion in inflows last week, bringing their total inflows to $5.94 billion since their inception. This means that the net inflows for the US crypto market, including Grayscale, have reached $807 million.

CoinShares suggested that the price decline was not due to a lack of demand but rather to the pre-purchase of Bitcoin seed capital by the new ETF issuers.

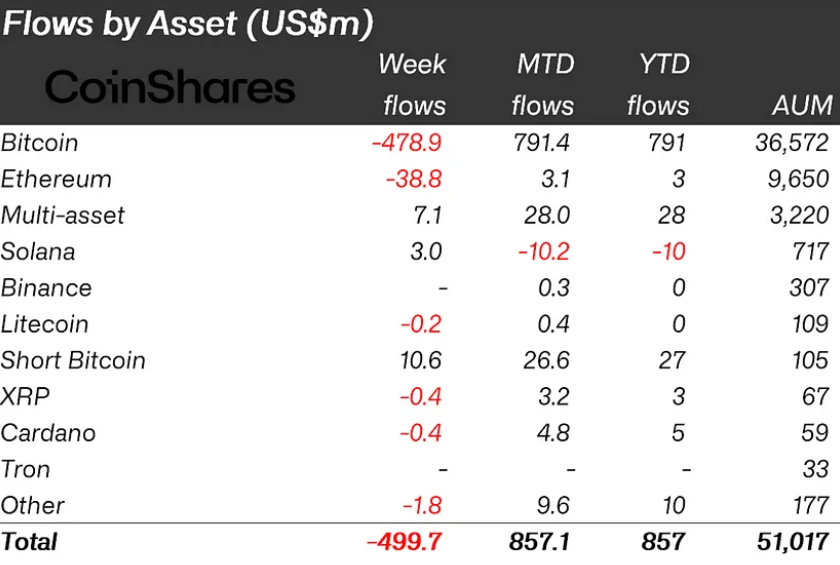

Bitcoin Suffered Largest Crypto Outflows Last Week

Bitcoin was the most affected by the outflows, losing $479 million last week, while short-bitcoin funds gained $10.6 million.

Other altcoins also suffered outflows, with Ethereum losing $39 million and Polkadot and Chainlink losing $700,000 and $600,000, respectively.

The only bright spot was the blockchain equities sector, which saw $17 million in inflows last week.

The report indicated that the crypto outflows were a sign of investors seeking new opportunities and diversifying their portfolios, rather than losing faith in the crypto market. If you want to stay updated on the latest crypto trends and opportunities, you can subscribe to our crypto signals service and get access to expert analysis and recommendations.