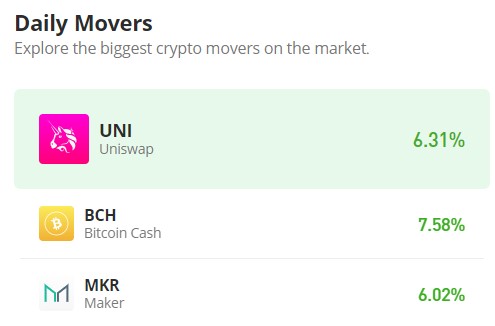

Solana (SOL/USD) Price Is Below $22, Striving for Increases

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Solana Price Prediction – September 29

In the process of Solana maintaining a pace to push against the US dollar, the crypto-economic trade is below $22, striving for increases above the support trade zone of $18.

The act of swinging for lows and highs has only produced a low path, denoting a slanting mode between the points of $20 and $19. The gravitational pressure supporting the moves up to this point has been significantly less active over the past few days. The overall disclosing technical mindset indicates that buyers would need to exercise caution when setting their position orders in order to avoid any potential rebounding motions that might soon reappear.

SOL/USD Market

Key Levels:.

Resistance levels:$22, $23, $24

Support levels: $18, $17, $16

SOL/USD – Daily Chart

The SOL/USD daily chart reveals that the crypto-economic price is below the $22 resistance line, striving for increases.

The 14-day SMA indicator is positioned at $19.69 underneath the $20.71 value line of the 50-day SMA indicator. A repositioning posture has been observed in the stochastic oscillators to denote that a rising force is ongoing, ranging from 56.39 to 73.87. The buying process appears to be heading toward completion.

What crucial support level should SOL/USD market buyers hold while pushing further?

As of the time of this technical analytics composure, the SOL/USD trade bulls would have to uphold above the support line of $18, given that the crypto-economic price is below $22, striving for increases in valuation.

Taking a quick glance at the stochastic oscillators’ reading picture, buyers should continue to trade alongside the bullish wall that has been formed as candlesticks have risen from the $18 lower trading support zone. Investors should keep fostering the mentality of staying long on the outlook of their investment goals.

According to the market’s formation pattern, selling activities are at risk of staging a comeback, while an upward push tends to wane at a specific resistance line. In short, bears should be cautious about opposing frightened surges.

SOL/BTC Price Analysis

In contrast, Solana has been underneath the trend line of the bigger moving average against Bitcoin, striving for increases.

In close proximity to the 50-day SMA trend line is the 14-day SMA trend line. Additionally, they are both oriented to the east. The stochastic oscillators are moving toward the north from a weak baseline that has less strength to support additional sustained moves in that direction. Range-bound locations will continue to be supported for some time, according to the transactional forecast. If that supposition is correct, traders will have to stake at the upper range point to place a shorting order, while the lower range line will be for purchasing entries.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK