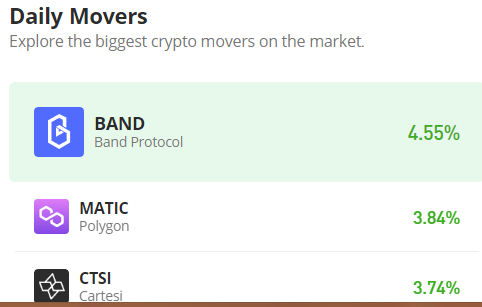

Uniswap (UNI/USD) Price Suffers a Reverse, Building on $6

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – January 4

A convergence of price actions that occurred recently has given bears in the market activities of Uniswap versus the US Dollar the situation that warrants the falling motion, as the crypto business suffers a reverse, building on $6.

The middle and lower Bollinger Band trend line zones are where the diminishing movements have been somewhat caged. It has been seen that the technical underpinning support points have settled from the $6 line to the $5 value.A smaller bullish candlestick has been forming as of this analytics article to support the likelihood of a quick rebound.

UNI/USD Market

Key Levels:

Resistance levels: $7.50, $8, $8.50

Support levels: $5.50, $5, $4.50

UNI/USD – Daily Chart

The UNI/USD daily chart showcases the crypto-economic price suffering a reverse, building on $6 as the fresh supportive line ahead of a further bullish-running cycle.

The stochastic oscillators have been in a southbound-crossing mood. As of the moment, a smaller bullish candlestick has been in the making to give rise to the potentiality of seeing more drops. The Bollinger Band indicators are placed systemically northwardly, depicting major resistance, and support lines are seen between $8 and $5.50, or $5 in an extension.

After dropping to $6, in which direction is the UNI/USD market currently trending in a positive direction?

The dumping in the valuation of the Uniswap market against the valuation of the US currency has demonstrated that the price is going for a necessary correction as the market suffers a reverse, building on the $6 line.

Given that the price movement has been gradually turning positive in the downward direction, it is advised that long-position movers be aware of an aggressive, powerful upsurge to play alongside when placing a positional order. To maintain the positive trade fantasy, purchasers should be cautious about any aggressive breakdown of points below the $5 value.

In the UNI/USD market, technical trade consideration for bears would require that orders for shorting positions be suspended until an overbought state is reached. Additionally, that circumstance must eliminate any chance of eventually gaining momentum and consolidating in a moving manner.

UNI/BTC Price Analysis

In contrast, the Uniswap trade suffers a reverse against the stances of Bitcoin, building on the horizontal line drawn between the middle and lower Bollinger Bands.

The stochastic oscillators have displayed the bearish gravitational pull that has been generated in the market, positioning at lower values to suggest that movements to the south have reached a significant maximal point. Both the middle and lower Bollinger Band indicators have produced areas where it is likely that the basic crypto economy will once again find impetuses to challenge the value of Bitcoin.

\

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK