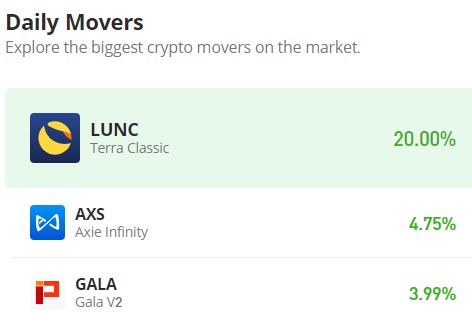

Uniswap (UNI/USD) Price Surges Higher, Averaging $6.50

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Uniswap Price Prediction – November 23

There have been significant aggressive uprising forces in the UNI/USD market operations, given the cryptocurrency business surges higher after a rebuilding base process around the point of $5, averaging the resistance line of $6.50.

Due to their ability to overcome the logical point of $5.50 to the upside during the most recent session, purchasers are expected to have market control, according to the situational financial record. As things stand, it would be premature to predict that bears will make strong entrances around the $6.50 resistance level. On the other hand, investors are likely to perform steadily during periods of huge uprisings.

UNI/USD Market

Key Levels:

Resistance levels: $6.50, $7, $7.50

Support levels: $5, $4.50, $4

UNI/USD – Daily Chart

The UNI/USD daily chart showcases that the crypto-economic market surges higher from around the point of $5, averaging the resistance line of $6.50.

It is likely for the northward pressure to reach the psychological resistance line in the near future. The Bollinger Band trend lines are in a northward-pointing mode. A bullish candlestick that emerged has produced a positive wall. The stochastic oscillators have crossed northward, allowing the blue line to push closely toward the other line to indicate that rising gravity is relatively ongoing.

How is the trade environment right now in terms of obtaining more consistent ups in the UNI/USD market along the upper Bollinger Band trend line?

As there has been an occurrence of a bullish candlestick in the UNI/USD market, spanning from the middle of the Bollinger Band trend line, capitalists should be rest assured that their investment purse is going back to a way of recoveries, having surged higher, averaging the resistance of $6.50.

Notably, the condition that tends to create and rebuild the base on a gradual moving process has been the only one to affect the valuation of the crypto economy. Pushers of long holdings are advised to cooperate with investors by attempting to reverse their positions before making strong advances to the north and without overly leveraging them beyond what the market may need to build upon.

In the interim, selling activity is anticipated to occur only in the event that a bearish candlestick at a higher resistance line confirms the trend. In order to pursue such a situation, sellers would need to deliberately position their presence around the aforementioned restrictions. Should those indicated resistance values not be met, they will have to wait for somewhat higher

UNI/BTC Price Analysis

In contrast, Uniswap surges higher against the market worth of Bitcoin, averaging a resistance that is not too far above the upper Bollinger Band trend line.

Not too far below the 80-point, the stochastic oscillators are moving in a northerly direction around the value. This suggests that the current smaller bullish candlestick has every chance of producing a longer path through overhead barriers. The trend lines of the Bollinger Band are progressively extending back towards the north from the upper side, indicating that the cryptocurrency on the lower side is beginning to face resistance from its counter-trading tool.

Note: Cryptosignals.org is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

You can purchase Lucky Block here. Buy LBLOCK