Bitcoin Options Trading Hits Record High in 2023 Year-End Surge

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

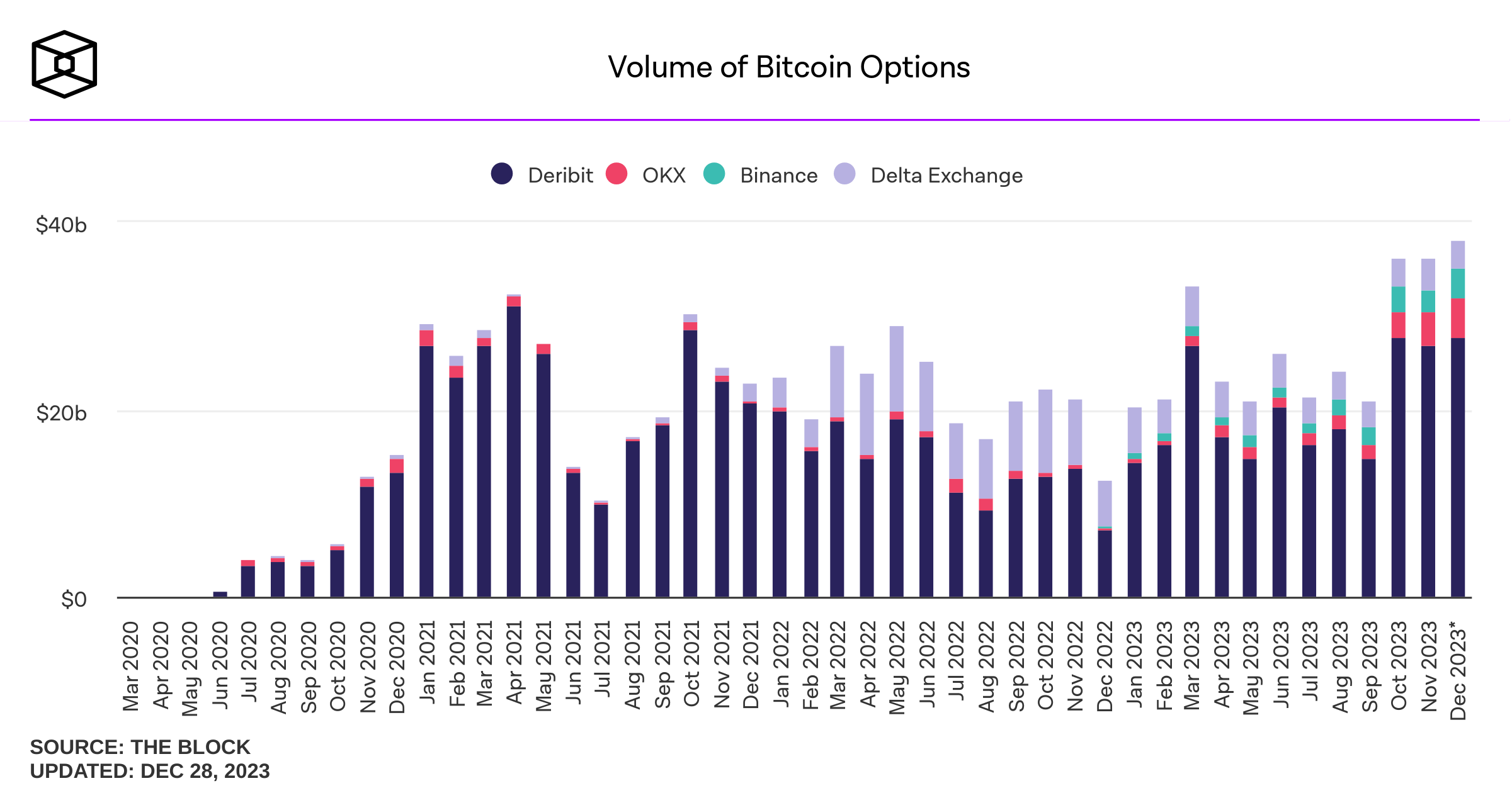

As 2023 draws to a close, Bitcoin options trading has reached unprecedented levels, reaching a new record high, as reported by The Block.

According to data from The Block’s Data Dashboard, the monthly options trading volume for Bitcoin, the leading digital asset by market value, has surged past $38 billion across major cryptocurrency derivatives exchanges.

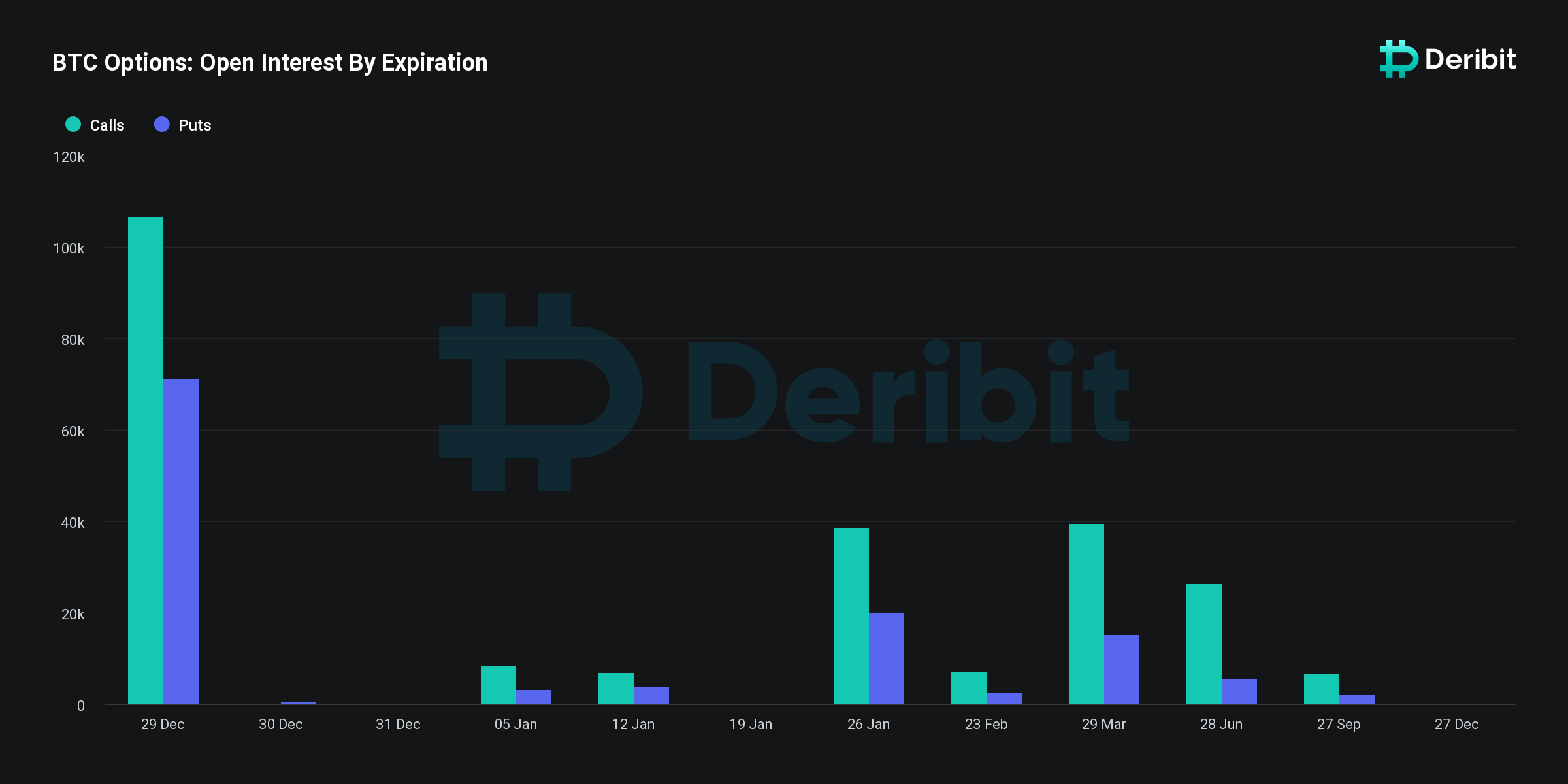

Key platforms contributing to this surge include Deribit, OKX, and Binance, with Deribit alone accounting for $26.7 billion in options trading. A pivotal date for Bitcoin options traders looms on Friday, December 29, as approximately $7.55 billion worth of contracts are set to expire on Deribit.

This marks the largest expiry in the history of the exchange, underscoring its dominance in the Bitcoin options market. Notably, a majority of these contracts are calls, indicating trader expectations for a rise in Bitcoin’s price.

However, with Bitcoin currently resting at $42,300, many of these contracts are currently “out of the money.”

Deribit’s Chief Commercial Officer, Luuk Strijers, told The Block that he anticipates heightened hedging and trading activity following the expiry, along with potential rollovers to 2024 contracts.

Additionally, market attention is closely fixed on the impending decision by the U.S. Securities and Exchange Commission (SEC) regarding the approval of a Bitcoin exchange-traded fund (ETF).

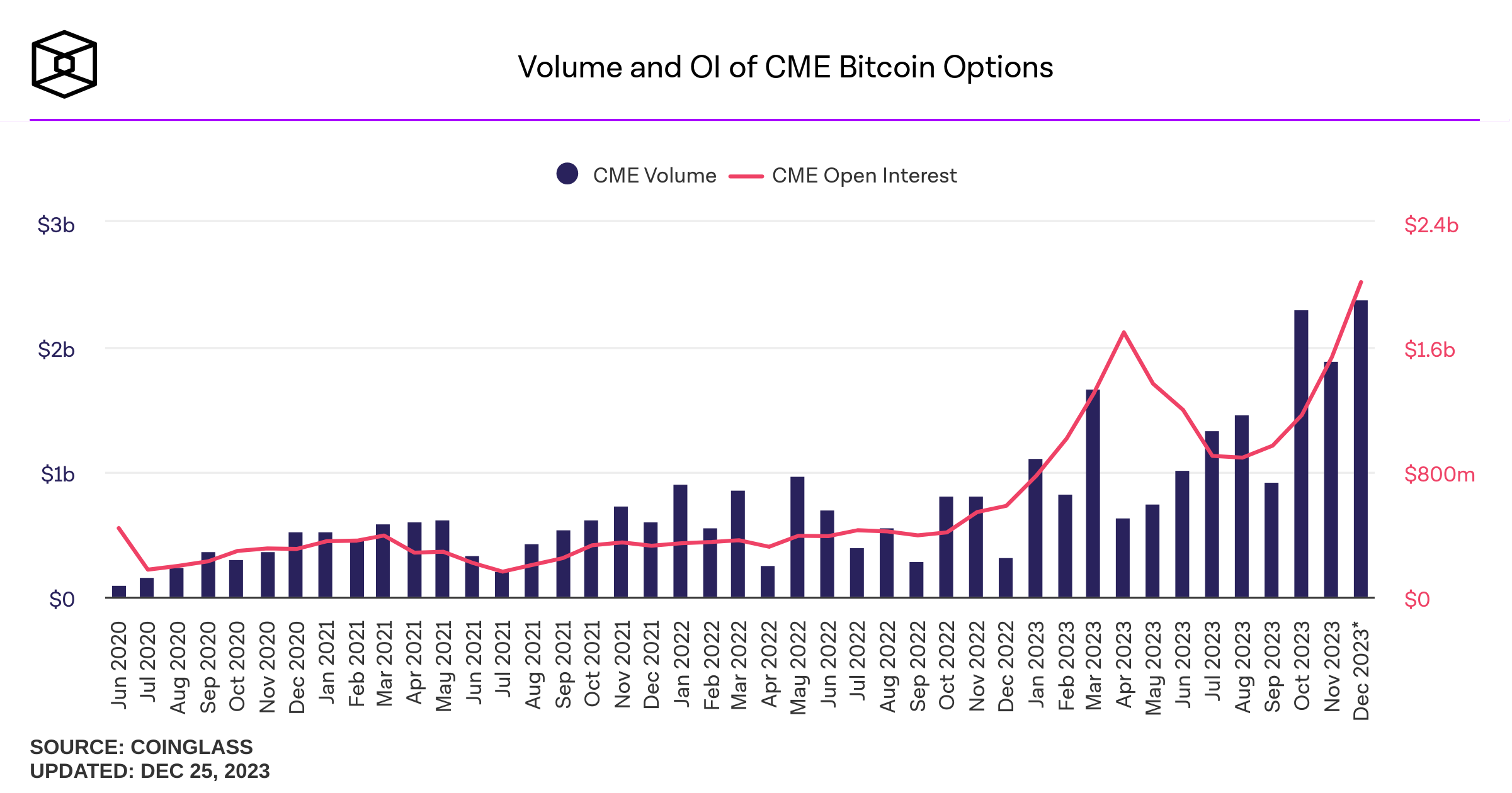

Interest in Bitcoin Options on CME Surges to Record High

Further affirming the surge in Bitcoin options interest is the record-breaking volume on the Chicago Mercantile Exchange (CME), a globally significant and regulated derivatives market. The Block’s Data Dashboard reveals that CME Bitcoin options trading volume has soared to approximately $2.4 billion in December, with open interest hitting an all-time high of over $2.02 billion.

As the year-end approaches, BTC options and futures traders find themselves in a volatile and uncertain market. Factors such as the SEC’s ETF decision, global macroeconomic conditions, and supply and demand dynamics could significantly influence Bitcoin’s price.

Traders are urged to exercise caution, implement robust risk management strategies, and remain prepared for various market scenarios.