Crypto Options Market Sees Surging Activity Amid ETF Anticipation

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The crypto options market is experiencing a notable surge in activity, with investors making bold bets on the future price movements of Bitcoin and Ethereum.

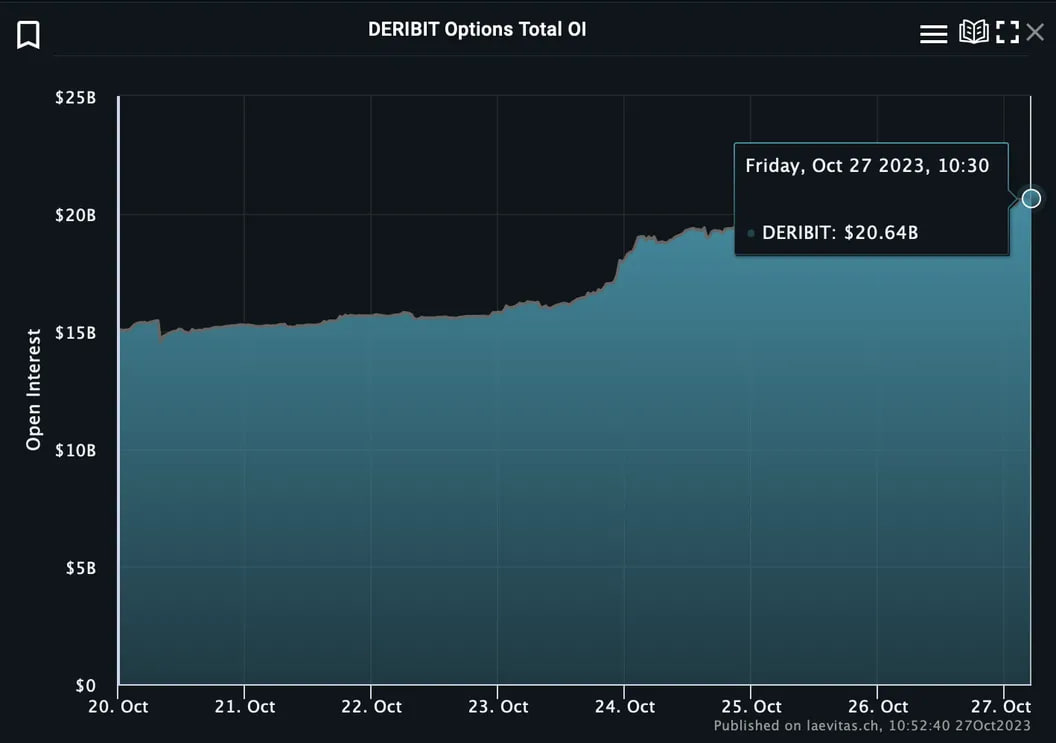

Swiss-based analytics firm Laevitas reports that the total notional open interest of options contracts for these cryptocurrencies on Deribit, the leading crypto options exchange, has reached a substantial $20.64 billion. This figure is approaching the record high observed in November 2021, according to CoinDesk.

What Are Crypto Options?

Options, which are financial derivatives, grant the buyer the right (but not the obligation) to purchase or sell the underlying asset at a predetermined price by a specified date. Call options enable buying, while put options enable selling. Traders employ these contracts to hedge positions, speculate on price changes, or generate income through premiums.

The growing interest in crypto options reflects the maturation of the crypto market and the anticipation of increased institutional adoption and regulatory clarity. A significant catalyst for this optimism is the amped-up anticipation for spot Bitcoin exchange-traded funds (ETFs) approvals in the United States. These ETFs plan to track the price of Bitcoin and provide investors with a regulated and convenient means to access the crypto market, bypassing custody and security challenges.

The ETF fervor has also invigorated demand for Ether, the second-largest cryptocurrency by market value, which fuels the Ethereum network. Ether has recently reached a local high of $1,865, buoyed by a wave of spot ETF interest. Analysts speculate that the U.S. Securities and Exchange Commission (SEC) may soon approve a spot Bitcoin ETF, further expanding investment options.

Huge Haul of Options Set to Expire

Nevertheless, the crypto market is renowned for its volatility and unpredictability. On the horizon, Deribit will settle monthly Bitcoin and Ether options contracts worth a substantial $4.5 billion later today, potentially injecting turbulence into the market as traders adjust their positions or exercise options.

Therefore, prospective investors must exercise caution and arm themselves with knowledge before venturing into the crypto options market. This market offers significant risks and rewards, and it is crucial to approach it with prudence.