NYDIG Research Predicts $30 Billion Surge in Demand for Bitcoin ETFs

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The crypto market is buzzing with excitement as spot-based exchange-traded funds (ETFs) for Bitcoin are poised to bring about a massive $30 billion in fresh demand, according to a comprehensive research report by NYDIG, a prominent crypto trading firm.

In recent weeks, the fervor surrounding these potential ETFs has intensified, driven by filings from heavyweight financial institutions such as BlackRock, WisdomTree, Nasdaq, and Fidelity, among others.

According to CoinDesk, NYDIG’s report highlights the unique advantages that a spot ETF could offer when compared to existing alternatives. One of the key factors contributing to the potential success of Bitcoin ETFs is the brand recognition of BlackRock and its renowned iShares franchise.

Investors are already familiar with the ease of purchasing and selling assets through securities brokers, which could streamline the process and make Bitcoin ETFs more accessible to a broader audience. Additionally, the simplicity of position reporting, risk measurement, and tax reporting would further enhance the appeal of these ETFs.

Bitcoin vs. Gold ETFs: A Tale of Two Assets

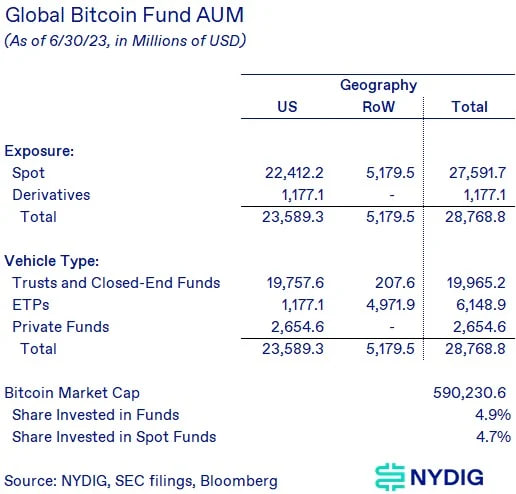

Often referred to as digital gold, Bitcoin has inevitably drawn comparisons to gold ETFs that emerged in the early 2000s. NYDIG’s report reveals that gold ETFs currently hold a meager 1.6% of the total global gold supply, while central banks command a sizable 17.1%.

In contrast, Bitcoin funds have secured 4.9% of the total Bitcoin supply. This discrepancy in holdings indicates that there is still considerable room for growth in Bitcoin investments, particularly if ETFs gain traction.

That said, a striking disparity exists in the demand for traditional and digital assets within funds. While gold funds boast investments surpassing $210 billion, Bitcoin funds currently trail behind at $28.8 billion.

However, the potential for Bitcoin ETFs to bridge this demand gap remains promising, and if successful, they could unlock significant capital inflows into the cryptocurrency market.

NYDIG Report Highlights the Need for Understanding Volatility and Demand

The NYDIG report delves into the subject of volatility, revealing that Bitcoin is approximately 3.6 times more volatile than gold. This means that investors would need 3.6 times less Bitcoin than gold, on a dollar basis, to achieve an equivalent risk exposure.

Despite its volatility, the potential for a Bitcoin ETF to generate almost $30 billion in incremental demand is significant, further emphasizing the latent potential in the cryptocurrency market.

You can purchase Lucky Block here. Buy LBLOCK