Record Crypto Inflows Push Crypto Assets Under Management to Pre-Crash Levels

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

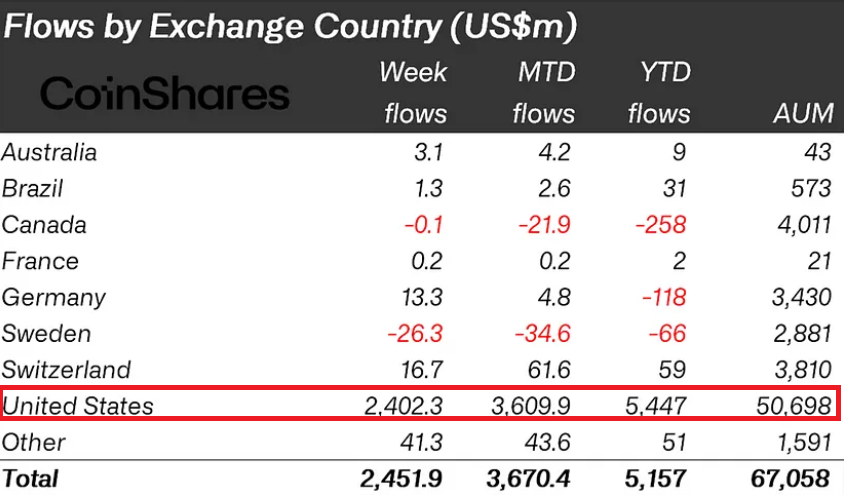

Digital asset investment products saw record weekly crypto inflows of $2.45 billion last week, the highest ever, according to a report from CoinShares Research. These inflows have pushed the total assets under management (AUM) to $67 billion, the highest level since the crypto crash in December 2021.

The torrent of crypto inflows flooded in overwhelmingly from the United States, which accounted for a staggering 99% of the total at $2.4 billion.

This signals a watershed moment, with rapidly accelerating interest in spot bitcoin ETFs now hitting fever pitch among US institutional investors. Meanwhile, incumbent crypto fund providers saw dramatically reduced outflows as money rushed into the surging bitcoin spot price.

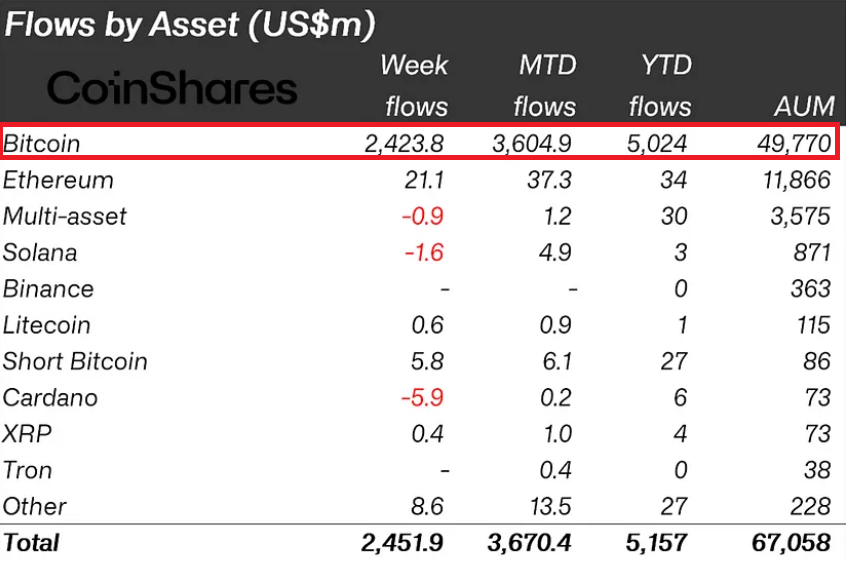

Bitcoin Attracts 99% of Crypto Inflows this Week

Bitcoin itself took in the vast majority of new investments, over 99% of the total. Some savvy US investors also added to short bitcoin positions, which saw inflows of $5.8 million.

Other major cryptocurrencies benefiting were Ethereum, with $21 million of inflows, and smaller amounts into Solana, Avalanche, Chainlink, and Polygon.

In contrast to the raging spot crypto market, investors chose to take profits and pull out $167 million from blockchain equity ETFs last week. This suggests a divergence in interest between direct ownership of cryptoassets themselves and publicly traded blockchain companies.

Overall, the floodgates now appear open in terms of US institutional appetite for direct cryptocurrency exposure.

Bitcoin Targeting All-Time High

Over the weekend, Bitcoin maintained a steady price action, anchoring its price around the $52,000 local peak area. As the new week begins, we expect to see renewed price action, with the benchmark cryptocurrency taking another shot at the $53,000 mark.

Bitcoin is likely to leverage the positive sentiment typical of February to draw even closer to its $69,000 ATH ahead of the halving event in April.

For the latest real-time crypto signals, sign up for our premium Telegram channel.