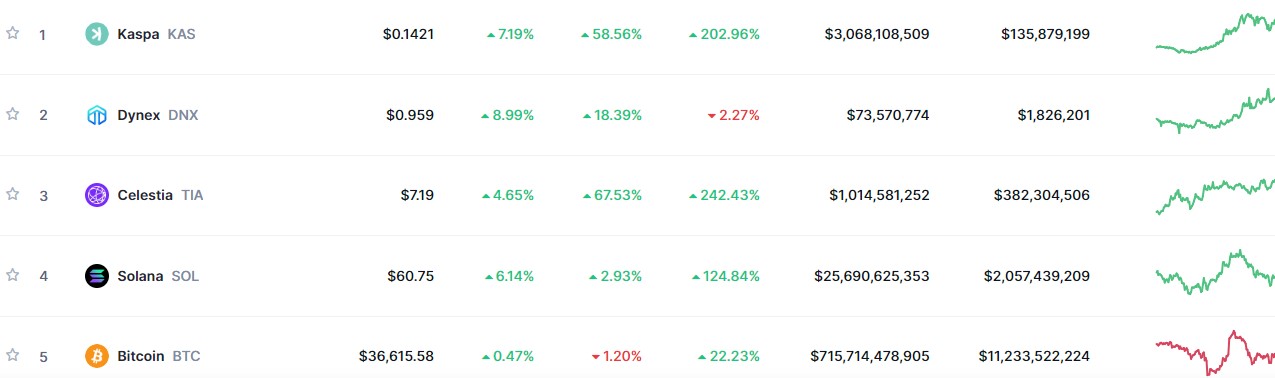

Top Trending Coins for Today, November 19: KAS, DNX, TIA, SOL, and BTC

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

In this week’s overview of trending cryptocurrencies, the Kaspa market has prominently surged, registering a remarkable 58% increase over the past seven days. Bitcoin, Celestia, and Solana have consistently maintained their positions within the top 5 trending markets for the current week. Notably, throughout November, a significant portion of the cryptocurrencies listed as trending coins have demonstrated considerable momentum, achieving higher price levels.

Kaspa (KAS)

Major Bias: Bullish

The Kaspa market has exhibited substantial gains since early November, achieving an impressive 202% increase during this period. The month of November has proven highly favorable for the market, commencing at the $0.05 price level and experiencing a substantial bull rush that elevated it to the $0.142 price level.

This aggressive bullish performance has heightened volatility, providing bears with opportunities to assert themselves at key resistance levels. Consequently, bearish activities at the $0.100 and $0.140 price levels have induced a significant bearish sentiment, causing a slight divergence in the lower standard deviation of the Bollinger Band.

However, following a robust bullish move on November 15, it is evident that bullish sentiments are more pronounced. This leads us to consider the possibility of the market continuing its upward trend. Nevertheless, the observed drastic drop in trade volume as the market reached $0.1400 suggests that consolidation or retracement at this level may be the next development in the market.

Current Price: $0.1426

Market Capitalization: $3,068,108,509

Trading Volume: $135,879,199

Dynex (DNX)

Major Bias: Bullish

The Dynex market ranks second among the top-performing crypto markets this week, posting a modest 18% gain over the past seven days. However, a broader perspective over the last 30 days reveals a marginal 2.27% loss. Despite this, the market sustained bullish sentiment throughout the concluded week, consistently staying above the 20-day moving average.

An analysis of the Bollinger Bands suggests a horizontal moving price channel, indicative of a ranging market. Despite the bullish sentiment and the market’s position above the moving average, the observed pattern suggests a lack of a clear price direction.

Throughout the week, a notable increase in volatility levels was observed, impacting liquidity in both bull and bear markets. The market witnessed a faceoff between bulls and bears, resulting in a lack of clear establishment of a definitive price direction.

Current Price: $1.007

Market Capitalization: $73,570,774

Trading Volume: $1,826,201

Celestia (TIA)

Major Bias: Bullish

In third place stands the Celestia market. While the chart suggests a recent emergence, its performance has been noteworthy since the start of the month. Aside from the first week’s period of stagnancy in November, the market has consistently achieved higher price levels since the second week. Over the course of the month, the market has seen a substantial 67% gain and successfully established $7.00 as the latest higher support level, previously a resistance point.

Although facing bearish resistance above the $7.00 price level, the newfound support at $7.00 is anticipated to stabilize the market. This support level should, at a minimum, facilitate a consolidation trend in the market, especially considering the observed drop in trade volume.

Current Price: $7.19

Market Capitalization: $1,014,581,252

Trading Volume: $382,304,506

Solana (SOL)

Major Bias:Bullish

Solana has maintained its momentum over the past two weeks, securing its place among the trending coins for the current week. From the beginning of November until now, Solana has demonstrated an impressive gain of 242%, although its weekly gain is a more modest 2.93%. The market appears to be in a consolidation phase for the week, rather than actively gaining and achieving higher price levels. This consolidation is evident around the $57.95 price level.

Despite a recent drop in trade volume, signaling potential upcoming declines in volatility, the $60.00 resistance price level is facing bullish pressure. This resistance level was breached earlier in the week, reaching a high of $68.23 before facing resistance from bears and retracting to $58.41. With the prevailing bullish sentiment, it is reasonable to anticipate further bullish actions in the upcoming week.

Current Price: $60.23

Market Capitalization: $25,690,625,353

Trading Volume: $2,057,439,209

Bitcoin (BTC)

Major Bias:

Bitcoin holds the fifth position in this week’s list of trending coins. Bulls have exerted control over the market since mid-October, propelling prices to notable levels until November 9, when the market reached a peak at the $38,000 mark. Subsequently, the market has entered a sideways consolidation phase within a horizontal price range.

However, despite this consolidation, substantial histograms indicate sustained investor interest in the market. It is noteworthy that the volume of trade indicator has started to display a decrease in the height of the histograms. This development suggests a potential shift to the downside, as investors may seek to quickly secure their profits.

Current Price: $36,480

Market Capitalization: $715,714,478,908

Trading Volume: $11,233,522,224