The native token of decentralized exchange (DEX) dYdX, has surged by over 45% within the last 48 hours, reaching a peak of $4.364—a pinnacle not witnessed since April 2022. This impressive rally unfolds just 16 days before a pivotal token unlock event set to unleash over $500 million worth of DYDX to early investors and core team members, as reported by CoinDesk.

dYdX, a DEX renowned for facilitating spot, margin, and perpetual contracts on diverse crypto assets, recently unveiled its layer-1 blockchain based on Cosmos. This strategic move aims to enhance scalability, security, and the overall user experience for the DEX while allowing validators to earn a share of trading revenue as a reward for staking.

The migration of the DYDX token from Ethereum to the new blockchain accompanied the launch of its own chain. Acting as a governance and utility token, DYDX empowers holders to participate in voting on proposals, access exclusive features, and earn rewards. Over the past month, the cryptocurrency has more than doubled in price as anticipation for the token’s transition grew among speculators.

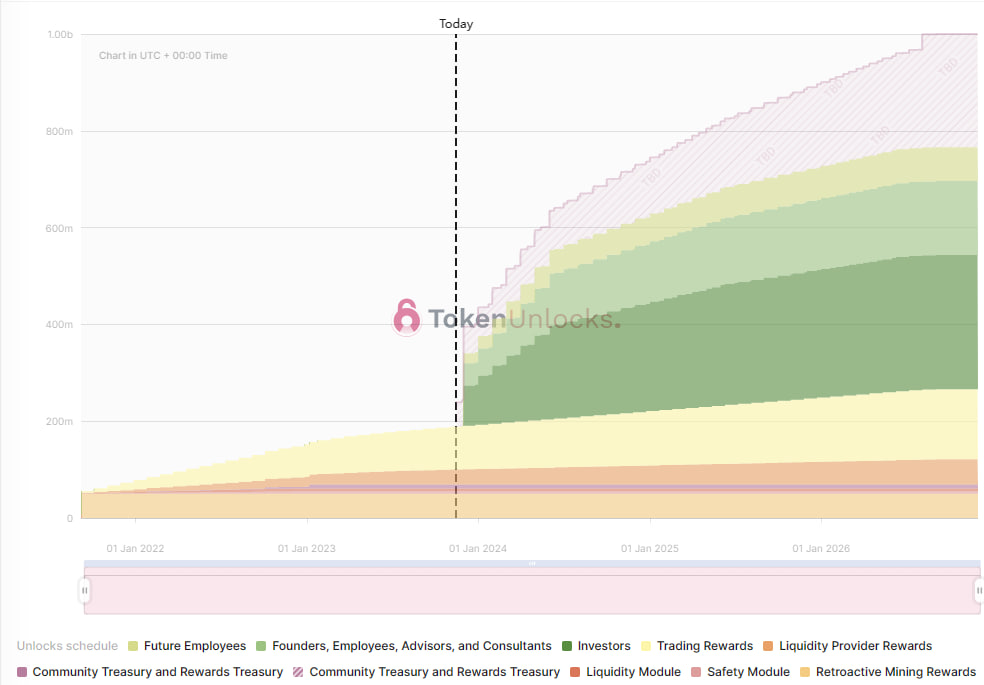

However, a potential challenge looms in the form of a substantial unlock event scheduled for December 2, 2023. This event is poised to elevate the circulating supply of DYDX from 179 million to 395 million, marking a significant 120% increase. Concerns arise about potential selling pressure as investors may opt to cash in their profits.

dYdX CEO Proposes Incentive for Stakers

To counterbalance this risk, dYdX CEO Antonio Juliano has unveiled a new incentive program for staking the cryptocurrency. In an announcement on X, Juliano stated that stakers would receive “cold hard USDC,” a stablecoin pegged to the US dollar, and validators would enjoy 100% of trading fees. This innovative approach aims to encourage more users to stake their tokens, thereby mitigating the potential inflationary impact of the impending unlock.

Stakers on the dYdX Chain receive cold, hard $USDC

— Antonio | dYdX (@AntonioMJuliano) November 14, 2023

With $409 million in total value locked and an impressive daily trading volume surpassing $800 million, dYdX stands as one of the leading DEXs in the crypto space. The community’s loyalty and continuous growth underscore the anticipation surrounding the impact of the upcoming token unlock on dYdX’s price and popularity.