Crypto Outflow Reflect Investor Caution Amid Market Volatility

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Last week, digital asset investment products experienced a minor crypto outflow of $126 million, indicating investor caution amidst stalled price momentum, as per the latest report from CoinShares.

Despite a slight increase in volumes—from $17 billion to $21 billion week-on-week—ETP/ETF activity saw a drop relative to the overall market. Trusted exchanges, which represented 40% of total volumes over the past month, witnessed a decline to 31% last week, signaling investor hesitancy.

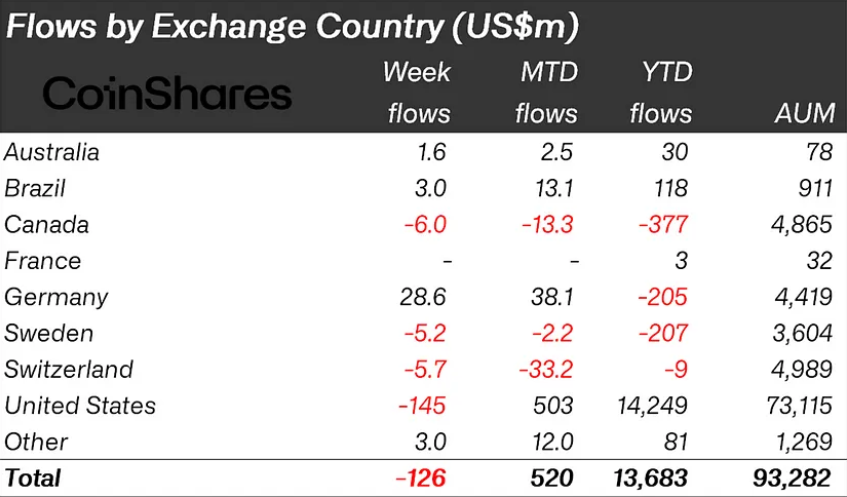

Inflows and Outflows Based on Region

- United States: The US recorded the largest outflows, amounting to $145 million, reflecting cautious investor sentiment in response to recent market dynamics.

- Switzerland and Canada: Following suit, Switzerland and Canada experienced outflows of $5.7 million and $6 million, respectively.

- Germany: In contrast, German investors capitalized on recent price weakness, resulting in inflows of $29 million.

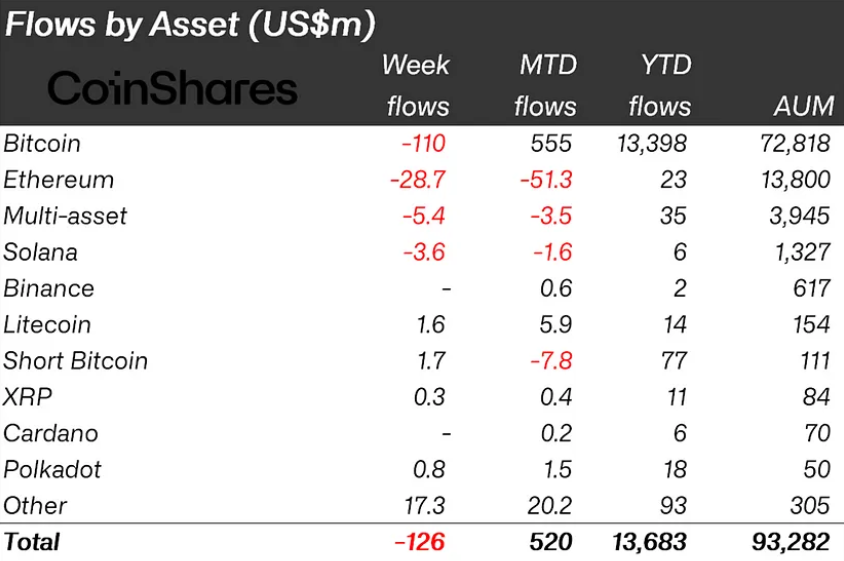

Crypto Outflow and Inflow Based on Assets

- Bitcoin: Despite outflows of $110 million, Bitcoin maintained positive month-to-date inflows of $555 million. Notably, short-bitcoin products saw minor inflows of $1.7 million, potentially capitalizing on recent price fluctuations.

- Ethereum: Ethereum faced significant relative outflows, losing $29 million last week, marking its fifth consecutive week of net outflows.

- Altcoins: While Solana experienced outflows of $3.6 million, other altcoins had a strong week. Decentraland, Basic Attention Token, and LIDO saw inflows of $4.9 million, $2.9 million, and $1.8 million, respectively.

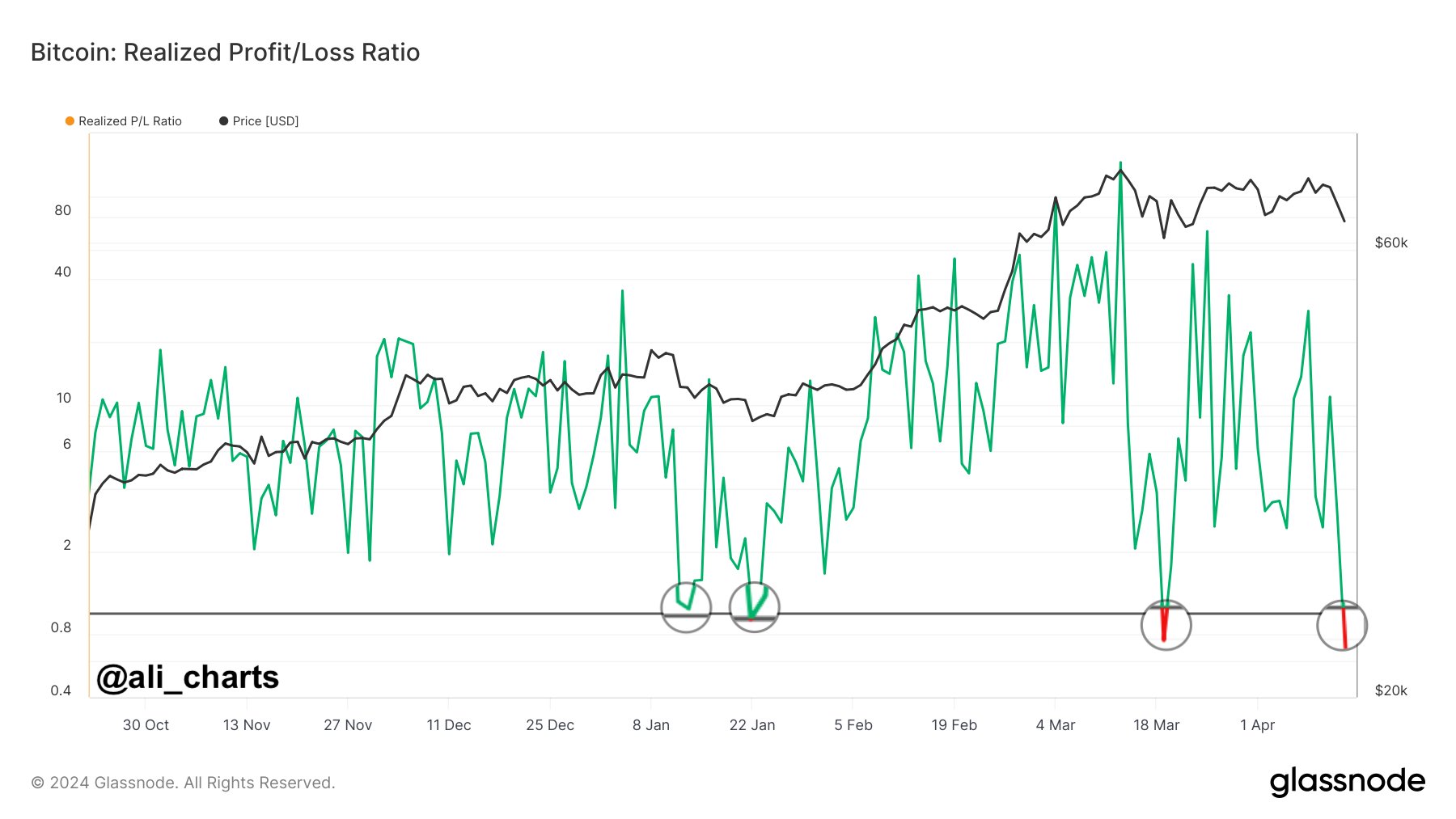

Bitcoin’s Realized Profit/Loss Ratio Drops

In related news, investors are bracing for volatility as Bitcoin navigates uncertain waters. Recent data by Ali Martinez reveals that Bitcoin’s realized profit/loss ratio has dipped below one (1).

This metric, comparing the sell value of Bitcoin with its purchase price, historically signals potential price bottoms, serving as a crucial indicator for market watchers.

Last week’s crypto inflows and outflows reflect a cautious approach among investors amidst market volatility. While some seize opportunities presented by price weaknesses, others remain wary, emphasizing the importance of monitoring key indicators for market trends.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here