Crypto Outflows Shake the Market Amidst Shifting Landscape

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

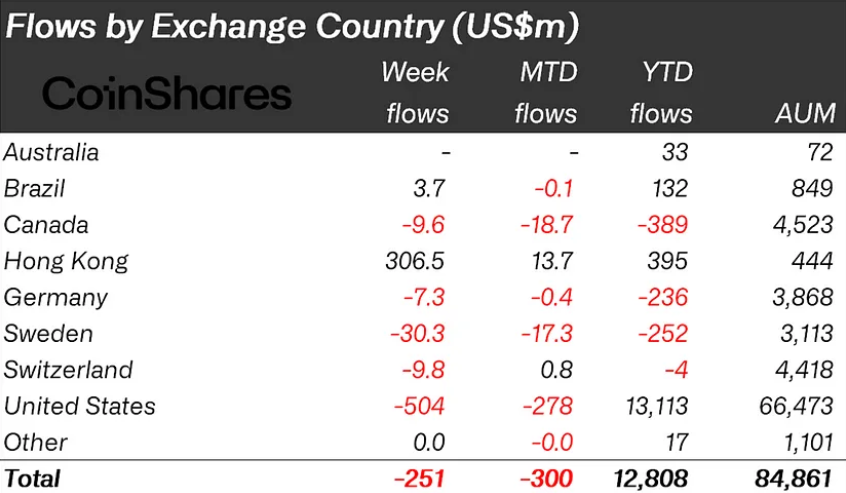

The cryptocurrency market has been rocked by significant crypto outflows in recent weeks, signaling a shift in investor sentiment. According to a report by CoinShares, investment products tied to digital assets saw a fourth consecutive week of outflows, totaling a substantial $251 million.

One of the most affected regions was the United States, where newly minted ETFs reported $156 million in outflows. Analysts attribute this trend to the market price of bitcoin dipping 10% below the average purchase price of these ETFs, triggering automated sell orders.

Crypto Outflows Recorded Across Board, Except for Hong Kong

However, the U.S. wasn’t alone in experiencing outflows. Canada, Switzerland, and Germany also saw outflows of $9.6 million, $9.8 million, and $7.3 million, respectively.

In contrast, Hong Kong’s financial scene saw a glimmer of hope with the successful debut of spot-based Bitcoin and Ethereum ETFs, attracting $307 million in inflows in their first week of trading.

Bitcoin, the flagship cryptocurrency, recorded $284 million in outflows, while Ethereum snapped its seven-week outflow streak, welcoming $30 million in fresh inflows. Other altcoins like Avalanche, Cardano, and Polkadot also saw investor interest, with inflows of $0.5 million, $0.4 million, and $0.3 million, respectively.

Spot Bitcoin ETFs Record Notable Investment Resurgence

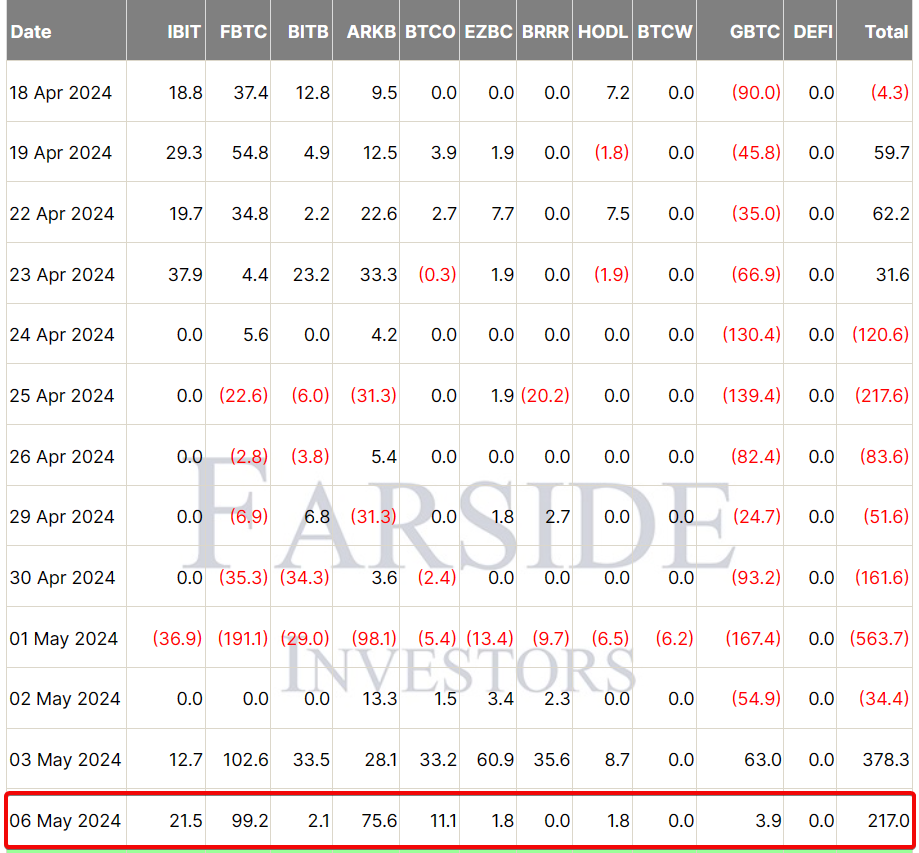

In a related development, U.S. spot Bitcoin ETFs experienced a resurgence with $217 million in net inflows on May 6th. This follows a period of pronounced outflows, with Grayscale’s GBTC trust still reeling from a historical net outflow of $17.4 billion since its launch.

Despite this, Grayscale’s GBTC managed to secure a modest inflow of $3.9 million, signaling a potential turnaround. Fidelity’s FBTC ETF led the way with a remarkable $99.2 million single-day inflow, followed closely by Ark Invest and 21Shares’ ARKB ETF, which drew $75.6 million in a single day.

These inflows have boosted the combined net asset value of these ETFs to $52.2 billion, accounting for 4.19% of Bitcoin’s total market value. The total historical net inflow for all spot Bitcoin ETFs now stands at $11.78 billion, indicating a shift in investor sentiment.

In response to market dynamics, Grayscale announced plans to launch a “Bitcoin Mini Trust” from GBTC, aiming to capture a share of the market with a lower-cost structure. The details of this new venture are eagerly awaited by the investment community, as they navigate the evolving landscape of digital assets.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here