Crypto Markets Records Massive Outflows Amid Price Corrections

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

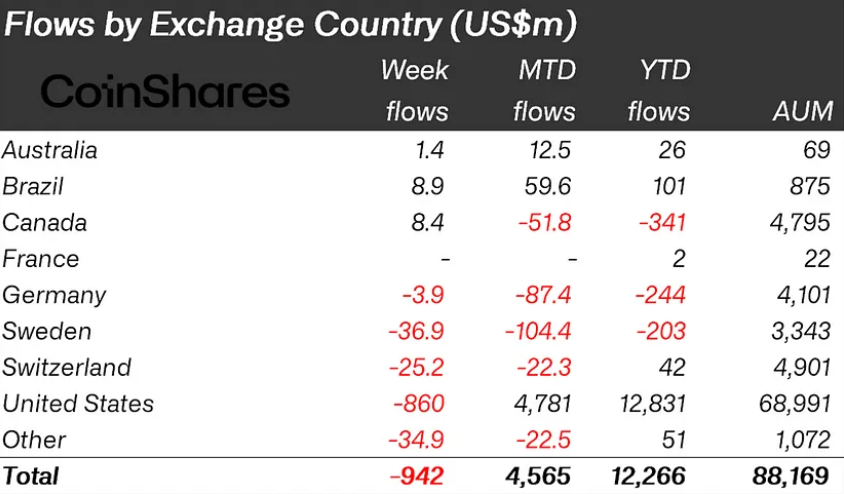

In a surprising turn of events, the crypto market has witnessed staggering outflows, with digital asset investment products reporting a record weekly withdrawal of $942 million, according to the latest data from CoinShares.

This marks the first significant crypto outflow after a remarkable seven-week streak of inflows, which amassed a total of $112.3 billion.

According to the report, the trading volumes for Exchange Traded Products (ETPs) remained robust at $28 billion for the week, albeit a decrease to two-thirds of the previous week’s figures.

A recent downturn in prices has led to a $10 billion reduction in the total assets under management (AuM), which, despite the setback, still hovers above the previous cycle’s peak at $88 billion.

US Investors Mostly Responsible for Spike in Crypto Outflows

CoinShares attributes the recent price dip to investor hesitancy, which has notably affected the inflow of capital into new Exchange-Traded Fund (ETF) issuers in the United States. These new ETFs saw an inflow of $1.1 billion, which only partially compensated for the significant $2 billion in crypto outflow from the established Grayscale funds last week.

The sentiment downturn was not exclusive to the US market. European countries such as Sweden, Switzerland, and Germany, along with Hong Kong, reported outflows of $37 million, $25 million, $35 million, and $4 million, respectively. In contrast, Brazil and Canada bucked the trend, with inflows totaling $9 million and $8.4 million, respectively.

Bitcoin, the leading cryptocurrency, constituted 96% of the total crypto outflows, with a substantial $904 million exiting the market. Additionally, short positions on Bitcoin also experienced minor outflows totaling $3.7 million.

Other major cryptocurrencies like Ethereum, Solana, and Cardano were not spared from the market’s bearish mood, witnessing outflows of $34 million, $5.6 million, and $3.7 million, respectively.

However, the broader altcoin market showed resilience, with a net inflow of $16 million. Notably, Polkadot, Avalanche, and Litecoin saw inflows of $5 million, $2.9 million, and $2 million, respectively.

Bitcoin Supply on Coinbase Shrinks to Record Low

In related news, data from the crypto analytics firm Glassnode indicates that the amount of Bitcoin held on Coinbase has plummeted to a nine-year low. This trend is corroborated by market intelligence platform Santiment, which reports a decline in Bitcoin holdings across centralized exchanges (CEXs).

This pattern, coupled with the recent trend of more outflows than inflows on these exchanges, suggests a potential rise in Bitcoin’s value, with speculations of it reaching an all-time high (ATH) of $75,000 in the near future.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here