Bitcoin Surges to $64,000 as Crypto Community Eyes Halving

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Bitcoin reached a remarkable milestone on Wednesday, hitting a local peak of $64,000, fueled by investor and miner anticipation surrounding the forthcoming halving event slated for April.

Scheduled every four years, the halving event reduces the number of bitcoins rewarded to miners for validating transactions, consequently inducing a scarcity effect that propels the digital asset’s price and demand.

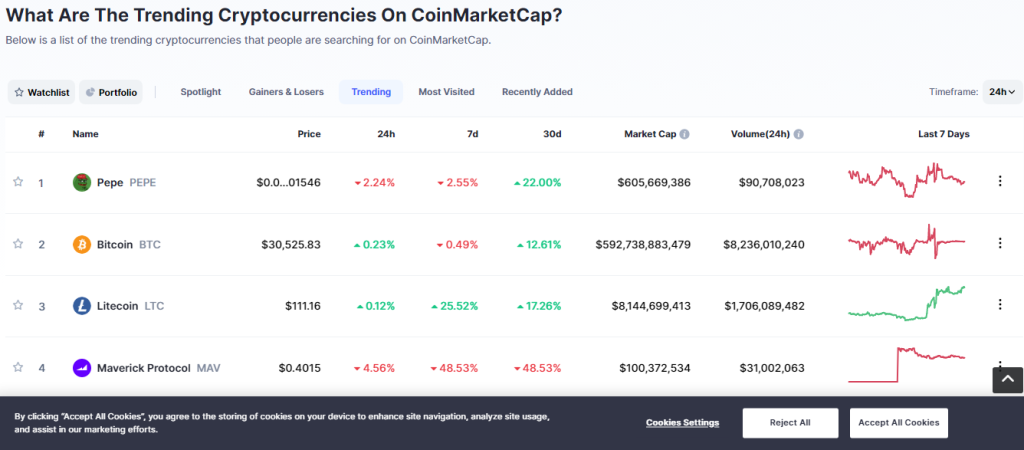

This bullish surge led to the liquidation of over $265 million in Bitcoin positions, predominantly shorts, totaling nearly $179 million, according to Coinglass. Bitcoin’s value has surged by over 45% since February’s onset, now commanding more than 50% of the total cryptocurrency market share.

Bitcoin ETF Inflows Heavily Support BTC Surge

Institutional investors’ mounting interest in Bitcoin, viewing it as a hedge against inflation and currency devaluation, is a key driver of this rally. Notably, BlackRock’s iShares Bitcoin ETF (IBIT) witnessed a record-breaking inflow of $520 million on Tuesday, as per BitMex Research.

[1/4] Bitcoin ETF Flow – 27 Feb 2024

All data now in.

$576.8m net inflow on 27th Feb, very strong day. Blackrock alone had $520m inflow

Total net inflow since 11th Jan 2024 now $6,726.1m for the ETFs pic.twitter.com/E0zDBkzqxm

— BitMEX Research (@BitMEXResearch) February 28, 2024

IBIT’s inflows surged by 5%, eclipsing its previous high of $493.1 million on February 13. Overall, U.S. spot bitcoin ETFs saw total net inflows of $519.8 million on Monday and $6.7 billion since their January 11 launch.

The behavior of miners, the network’s linchpin, also significantly influences Bitcoin’s price dynamics. According to Tuesday’s K33 market report, miners have been accumulating more bitcoins than usual in anticipation of the halving event.

Publicly listed bitcoin miners retained an estimated 29% of all bitcoin rewards in the past three months, sharply up from the January-November average of 2.5%, K33 analysts revealed. Miners are likely holding onto bitcoins to capitalize on higher prices and offset reduced rewards post-halving.

Historical data suggests that Bitcoin tends to rally before halving events, followed by post-halving consolidation. “For the previous three halving cycles, bitcoin’s average pre-halving 50-day return sits at a solid 30%,” the report highlighted. The upcoming halving event is slated for April 20, with the countdown already underway.

Stay ahead of the curve on cryptocurrency market developments and trends by subscribing to our crypto signals service.

Interested in learning how to day trade crypto? Get all the information you need here