Crypto Inflows Hit $598 Million in Fourth Straight Week of Growth

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

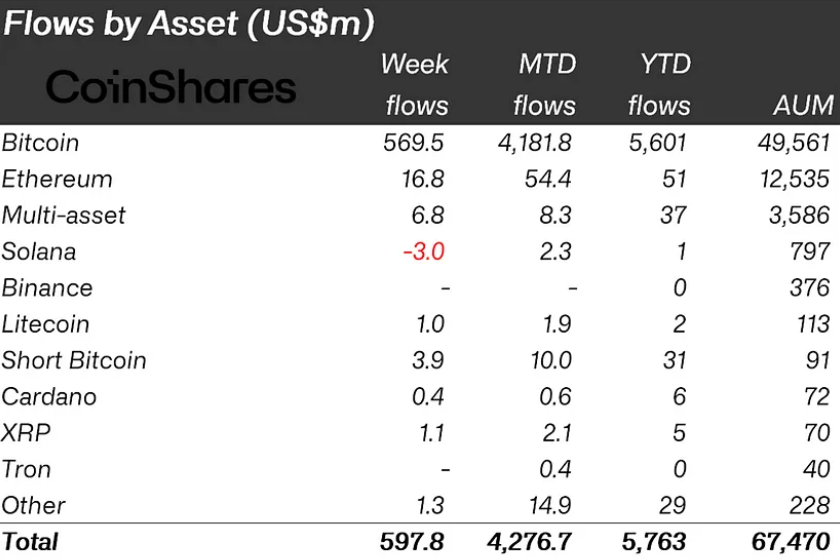

The demand for digital asset investment products continues to rise, as the latest report from CoinShares shows that crypto inflows reached $598 million last week. This marks the fourth consecutive week of positive inflows, bringing the total number of inflows in 2024 to $5.7 billion. This accounts for more than half of the record inflows of $10.4 billion that were recorded in 2021.

Total assets under management (AuM) of digital asset investment products hit $68.3 billion earlier this week, the highest since December 2021, but still below the all-time high of $87 billion in November 2021.

US Investors Responsible for Highest Crypto Inflows Last Week

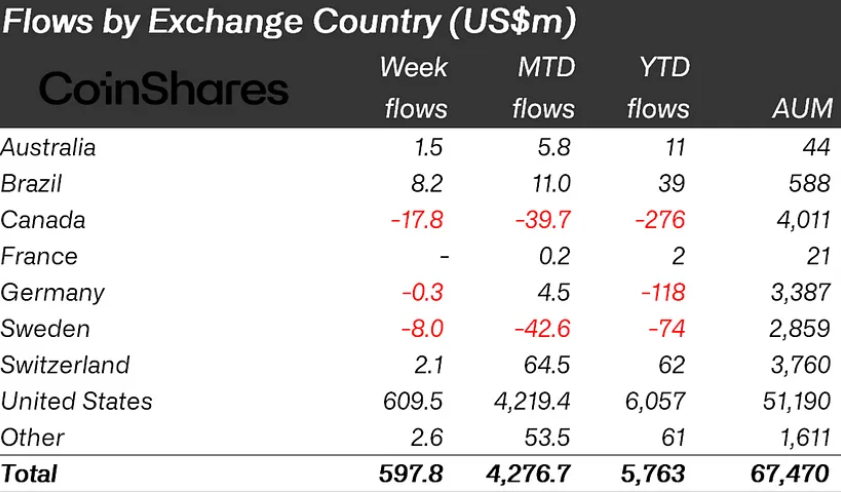

The US remains the leading market for crypto inflows, with $610 million flowing into US-based products last week. However, this was offset by $436 million in outflows from Grayscale, the world’s largest issuer of crypto products.

Brazil and Switzerland saw modest inflows of $8.2 million and $2.1 million, respectively, while Canada and Sweden experienced outflows of $18 million and $8 million, respectively.

Bitcoin attracted the most inflows, with $570 million last week, bringing the 2024 total to $5.6 billion. Some investors also entered short positions worth $3.9 million, taking advantage of the recent price surge.

Ethereum saw inflows of $17 million, while altcoins like Chainlink and XRP received $1.8 million and $1.1 million, respectively. Solana, however, experienced outflows of $3 million, possibly due to recent network issues.

Blockchain equities, stocks of companies involved in the crypto industry, saw outflows of $81 million last week, indicating a cautious approach by equity investors compared to crypto investors.

The crypto market continues to evolve, offering new opportunities and challenges. Stay informed with our Telegram for exclusive insights and analysis.

Interested in learning how to day trade crypto? Get all the information you need here