Crypto Inflows Surge Towards Record High, US Dominates Investments

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Crypto inflows surged to $1.18 billion last week, marking the second-highest weekly influx in history, according to CoinShares. This notable figure follows closely behind the record $1.5 billion inflow observed during the launch of the pioneering Bitcoin futures ETFs in October 2021.

According to the report, crypto exchange-traded products (ETPs) played a pivotal role, achieving an unprecedented trading volume of $17.5 billion last week. This milestone surpassed the previous record set in May 2021 at $15.9 billion.

Impressively, ETP trading volumes accounted for nearly 90% of daily trading volumes on reputable exchanges on Friday, underscoring a soaring demand for crypto exposure among investors.

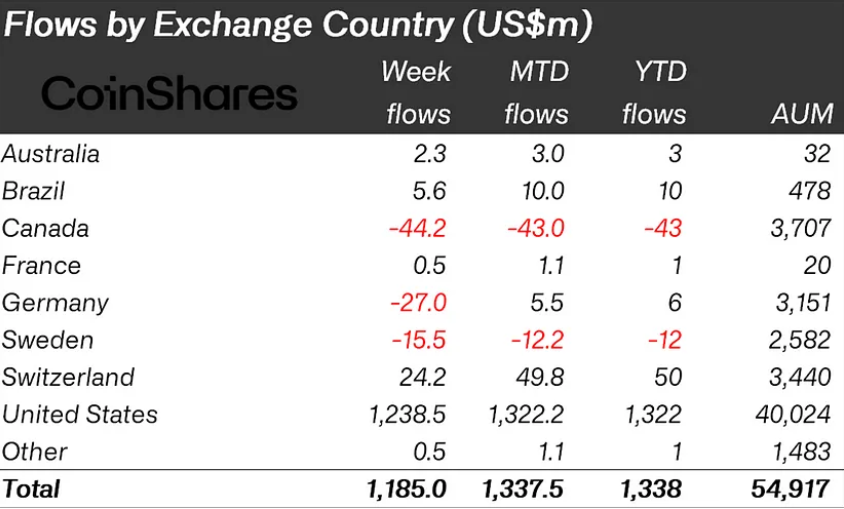

US Leads the Charge in Crypto Inflows Following Spot Bitcoin ETF Approvals

The United States emerged as the primary catalyst for the crypto inflows, attracting a substantial $1.24 billion, with Switzerland following suit with a commendable $21 million.

Conversely, certain European and Canadian markets experienced outflows, attributed by CoinShares to basis traders shifting from Europe to the US to capitalize on price differentials.

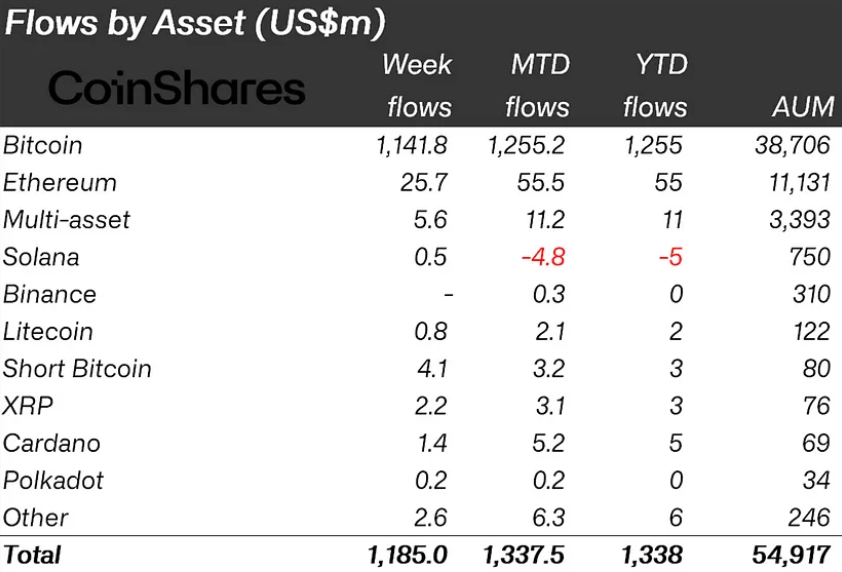

Bitcoin, the foremost cryptocurrency, received a significant inflow of $1.16 billion last week, equivalent to 3% of its total assets under management (AuM). This marked the highest weekly influx for Bitcoin since June 2021.

This robust inflow into crypto coincides with the approval of 11 spot Bitcoin ETFs by the US SEC last week.

Additionally, the short-bitcoin product, enabling investors to bet against Bitcoin’s price, saw minor inflows of $4.1 million.

Other cryptocurrencies, including Ethereum, XRP, and Solana, witnessed comparatively smaller inflows, totaling $26 million, $2.2 million, and $0.5 million, respectively. Ethereum, the second-largest cryptocurrency by market capitalization, experienced a decline in inflows in recent weeks as investor attention shifted towards Bitcoin and alternative assets.

The report also unveiled a surge in blockchain equities, the stocks of companies involved in the blockchain industry, attracting substantial inflows of $98 million last week. This brings the total inflows over the past seven weeks to an impressive $608 million, suggesting a broader investor interest in the crypto and blockchain ecosystem beyond digital assets.

CoinShares’ report underscores the escalating popularity and adoption of crypto, particularly in the US, where a favorable and supportive regulatory environment prevails. With the anticipation of an ongoing upward trend, the crypto market is poised for growth as an increasing array of products and services become available and accessible to the public.