Litecoin Navigates Choppy Waters Following Third Halving Event

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Litecoin, a prominent contender in the world of cryptocurrencies, finds itself at a crossroads in the aftermath of its much-anticipated third halving event, which unfolded on August 2. This halving, a recurring phenomenon in Litecoin’s ecosystem, marked a reduction in block rewards from 12.5 LTC to 6.25 LTC. However, the path post-halving has proven to be less than smooth, echoing the market reactions seen after similar events in 2015 and 2019.

LITECOIN HAS SUCCESSFULLY HALVED ITS BLOCK REWARD!

⚡ $LTC ⚡ pic.twitter.com/iemCnkPsdu

— Litecoin (@litecoin) August 2, 2023

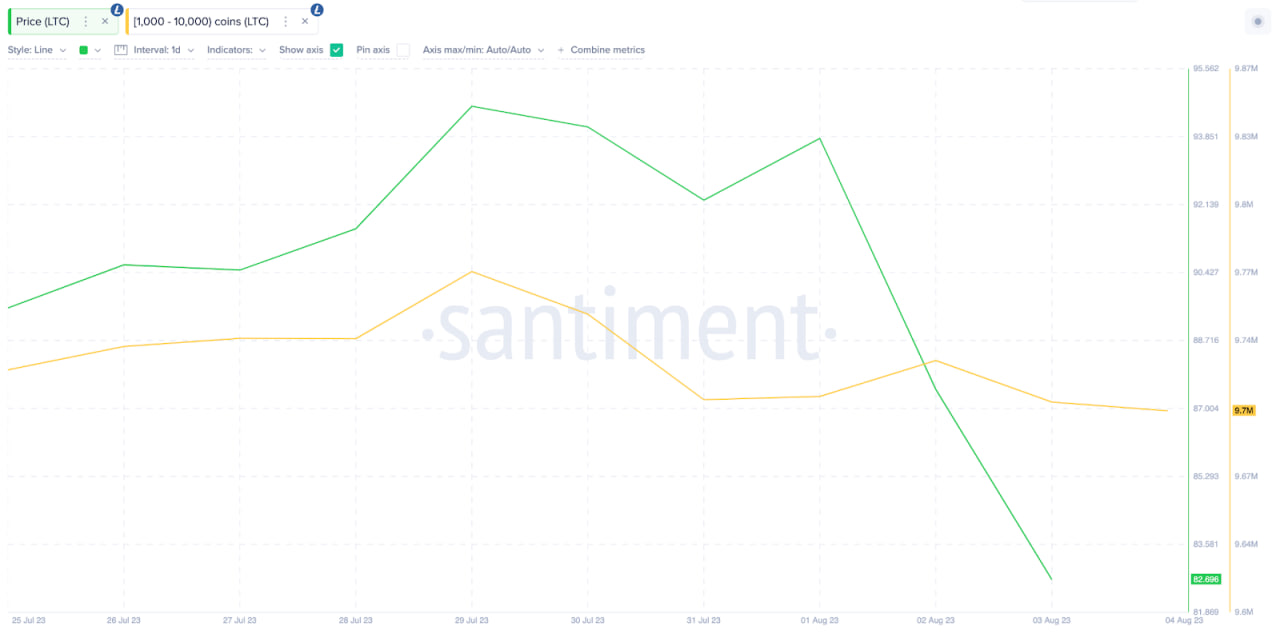

In a matter of hours, Litecoin’s valuation, which had tantalizingly grazed the $94 mark on August 1, experienced a noticeable retraction, settling at $83—a notable and somewhat anticipated 12% downturn. While this correction was on par with historical precedents, it’s the underlying on-chain analytics that are shedding light on a potentially extended slide.

Whale Selloff Partly Responsible for the Drop in Price of Litecoin

Insights gleaned from Santiment’s data have uncovered a pivotal role being played by whale investors—those who possess substantial holdings ranging from 1,000 to 100,000 LTC. These significant stakeholders displayed a discernible pattern by initiating a series of sell-offs in the days leading up to the halving event.

Throughout this period, their collective balance of 9.77 million LTC dwindled by 60,000 LTC, translating to an approximate market value of $5 million at the current price point of $83. This massive capital shift in such a short span could easily be interpreted as a strong bearish signal, potentially influencing other market participants.

According to BeinCrypto, the scenario at hand takes on an added layer of complexity when considering the possible involvement of retail investors in this ongoing wave of sell-offs. The cumulative effect of both large and small investors capitulating could further accentuate Litecoin’s price pressure, raising the specter of a potential breach of the $80 support level in the days to come.