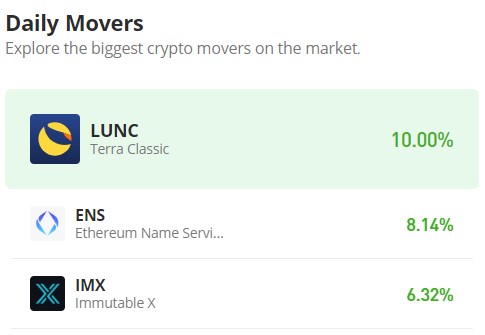

Ethereum Name Service (ENS/USD) Bulls Tackle the $20.00 Price Level

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Around January 11, the Ethereum Name Service encountered persistent rejections at the $26.64 price level. This recurring resistance above the $24 mark persisted for six days. The incapacity of the bull market to sustain itself above the $24 price level bolstered bearish sentiment. The selling pressure initiated on January 17 eventually led to a decline, reaching approximately the $16.00 price level. The bulls regained strength and displayed a willingness to buy at this level. Consequently, the market began to shift in favor of the bulls. However, this time, it had to contend with lingering bearish pressure as bears congregated around the $20 mark.

Ethereum Name Service Market Data

- ENS/USD Price Now: $19.76

- ENS/USD Market Cap: $611 million

- ENS/USD Circulating Supply: 39 million ENS

- ENS/USD Total Supply: 100 million ENS

- ENS/USD CoinMarketCap Ranking: #96

Key Levels

- Resistance: $20, $24, and $26.

- Support: $17, $16, and $15.

The Ethereum Name Service Market Analysis: The Indicators’ Point of View

In today’s daily trading session, a notable increase in investor interest was observed, evident in both the daily candlestick and the volume of trade histogram. Throughout the session, the price of Ethereum Name Service surged beyond the $20 resistance level, triggering a bearish response and reinforcing the resistance. Despite this, the bullish momentum, as indicated by the Relative Strength Index (RSI), is rapidly intensifying. This is discernible through the sharp ascent of the RSI line from the 50 level to the 57 level.

ENS/USD 4-Hour Chart Outlook

During the third 4-hour trading session, the market exhibited a state of equilibrium as bulls and bears engaged in a standoff. Nonetheless, this crypto signal culminated in a noteworthy bullish price breakout, reaching towards the $20 price level. The upper shadow on the bullish candlesticks signifies the influence and strength of bears at the critical resistance level. Due to recent fluctuations in supply and demand dynamics, market volatility in the Ethereum Name Service has experienced an uptick. Should the bullish trend persist, there is a possibility of price consolidation at the $20 level or the establishment of a support level in close proximity to the $20 mark.