Crypto Inflows Surge in 2023: Bitcoin Leads the Pack

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The year 2023 was a remarkable one for the digital asset industry, as it saw massive crypto inflows from investors who were attracted by the potential of cryptocurrencies and blockchain technology.

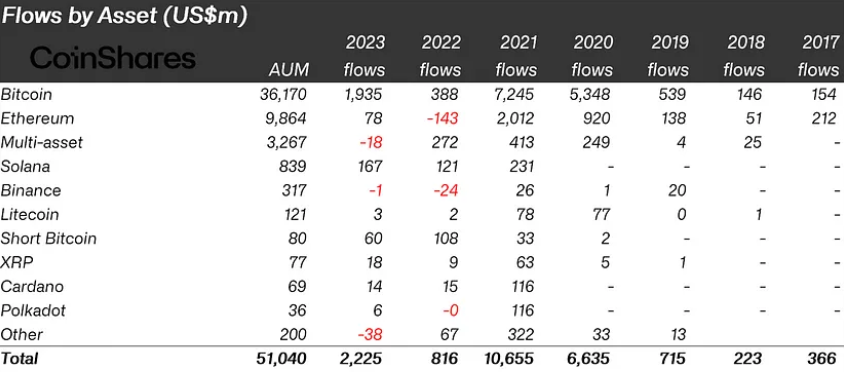

According to the latest weekly report by CoinShares, digital asset investment products received $2.25 billion of inflows in 2023, making it the third-best year on record since 2017. This was a significant improvement from 2022, when the inflows were only $816 million.

Factors That Influenced Crypto Inflows in 2023

This surge owes its roots to a confluence of factors, as reported by CoinShares. Institutional and retail investors alike contributed to the robust performance, spurred by an increasingly clear regulatory landscape and a wave of innovation sweeping through the sector.

Anticipation surrounding the Securities and Exchange Commission’s (SEC) potential approval of Bitcoin spot-based exchange-traded funds (ETFs) added further momentum.

Bitcoin Leads the Way

Bitcoin emerged as the undisputed leader among digital assets, commanding an impressive 87% of the total 2023 inflows, totaling $1.9 billion. This marked the highest share in the industry’s history, surpassing the previous record of 80% set in 2020.

The report suggested that Bitcoin’s allure stems from its status as the most established and liquid cryptocurrency, coupled with expectations of SEC approval for Bitcoin ETFs, which promise easier and more cost-effective market access for investors.

In contrast, Ethereum, the second-largest cryptocurrency by market capitalization, experienced a rebound in inflows, reaching $78 million in 2023. Yet, this figure remained a fraction of its total assets under management (AuM) at $11.4 billion.

Ethereum grappled with challenges such as high transaction fees, network congestion, and competition from platforms like Solana, which secured $167 million in inflows, constituting 20% of its AuM.

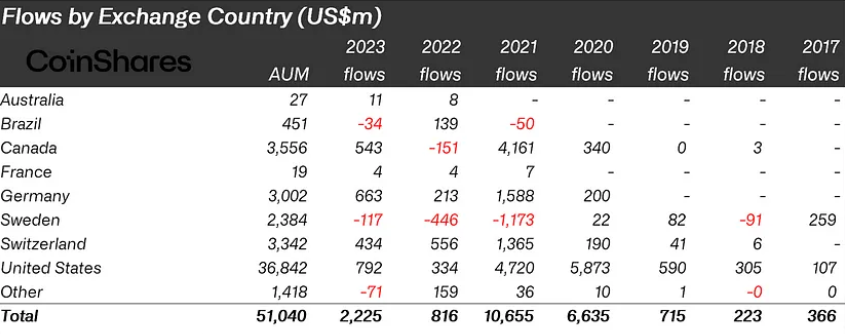

The distribution of inflows showcased regional disparities, with the United States leading at $792 million, followed by Germany with $542 million, Canada with $312 million, and Switzerland with $266 million.

Despite the substantial inflows, the report highlighted that US investors preferred spot-based ETFs over other digital asset products.

Beyond cryptocurrencies, blockchain equities demonstrated a remarkable performance. These stocks, associated with companies engaged in blockchain technology, witnessed a remarkable 109% increase in AuM in 2023, reaching $1.3 billion.

Inflows soared to $458 million, a striking 3.6-fold surge from 2022, underscoring the growing acknowledgment of blockchain’s value across diverse industries and sectors.