FTX Plans to Liquidate Massive Crypto Holdings: Will Altcoins Sink or Swim?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

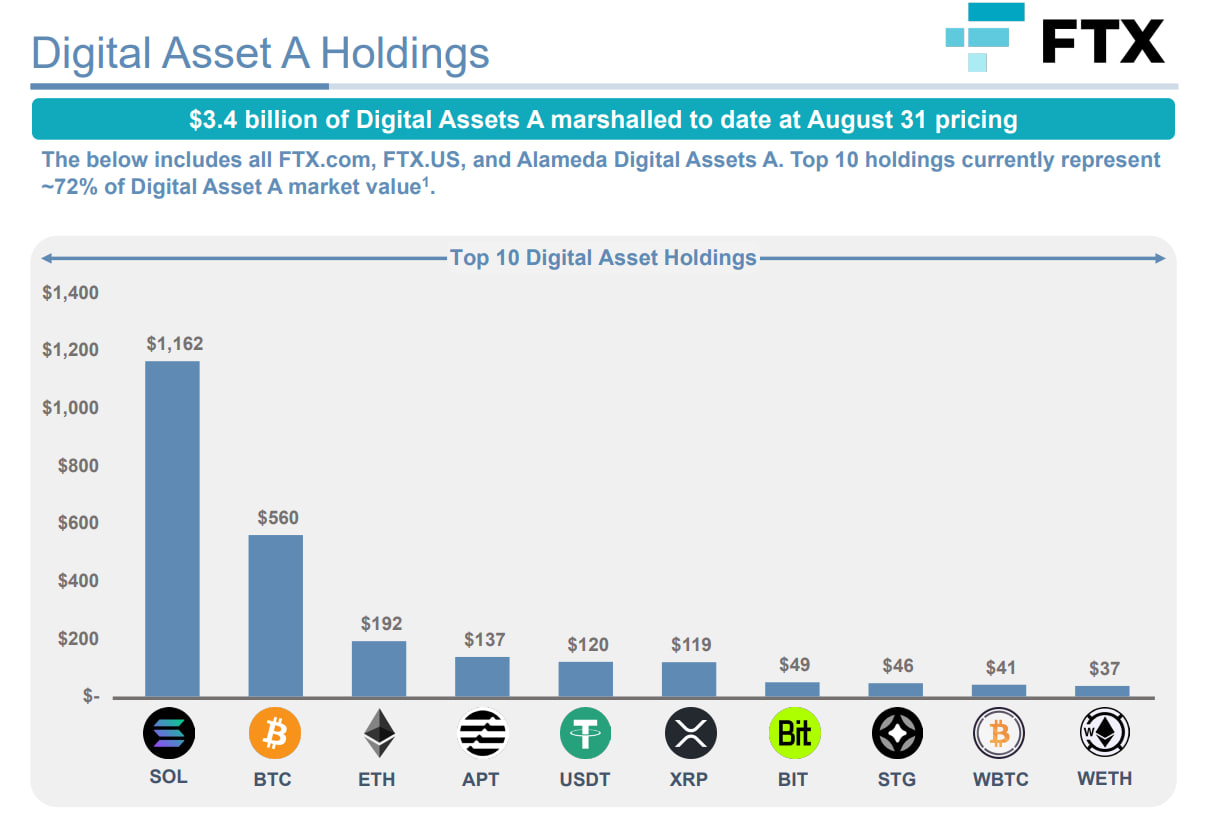

FTX, the embattled cryptocurrency exchange, has garnered court approval for its audacious plan to offload an estimated $3.4 billion in crypto assets. The strategy entails selling between $50 million and $100 million worth of crypto holdings each week, commencing this Saturday. However, this move has ignited concerns of a potential catastrophe within the already fragile altcoin market, plagued by dwindling liquidity and subdued trading volumes.

SOL Makes Up Significant Portion of FTX Holdings

Court documents reveal that FTX holds a staggering $1.16 billion in SOL, the native token of the Solana blockchain, and approximately $870 million in BTC, ETH, and USDT. Its substantial altcoin reserves encompass Aptos (APT), XRP, Bit DAO’s token BIT, and Stargate Finance’s STG token.

The market’s response to the liquidation plan was palpable, with altcoin prices taking a nosedive last week. Both SOL and APT are currently experiencing negative funding rates, indicative of bearish sentiment.

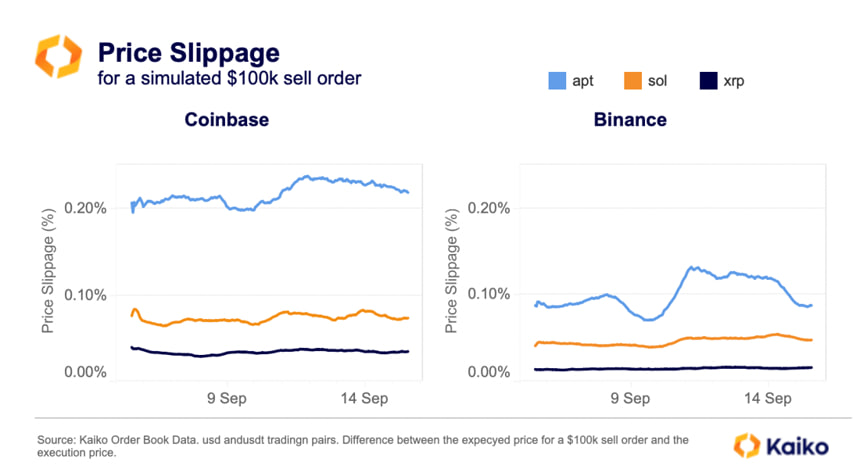

FTX faces a formidable challenge in identifying buyers for its altcoin trove without precipitating excessive price slippage. Slippage, the variance between the expected and actual trade execution prices, becomes more pronounced when liquidity is scant and trade volumes are colossal.

Kaiko Maps Out Possible Outcomes

An analysis by Kaiko, a prominent crypto data provider, underscores that BTC and ETH reign supreme in terms of liquidity, boasting trading volumes of $9 billion and $3.4 billion, respectively. XRP follows closely behind, while APT, BIT, and STG languish at the bottom with exceedingly low trading volumes and depth.

Additionally, Kaiko’s findings reveal a significant drop in liquidity for all altcoins over the past year. The most liquid altcoins on FTX’s balance sheet now hover around $50 million, plummeting from $90 million before the exchange’s troubles. This amounts to merely half of the upper weekly sales threshold.

To exacerbate matters, liquidity predominantly congregates within offshore exchanges, increasing the costs associated with selling in U.S. markets. Kaiko’s simulation of a $100k market sell order underscored that slippage is more pronounced on Coinbase compared to Binance.

In summation, FTX’s audacious crypto liquidation endeavor bears the ominous potential to trigger an altcoin market crash if it falters to secure buyers without unduly affecting prices. Market observers will be closely scrutinizing FTX’s moves in the weeks ahead as uncertainty looms large over the cryptocurrency landscape.