Digital assets have experienced a remarkable week, this past week, with crypto inflows into investment products surpassing a substantial $2.7 billion, per the latest data from CoinShares. This surge brings the year-to-date total to an impressive $10.3 billion, edging closer to the all-time high of $10.6 billion recorded in 2021.

The market’s vigor is further highlighted by a record-breaking weekly trading turnover, reaching $43 billion, a significant increase from the previous week’s $30 billion.

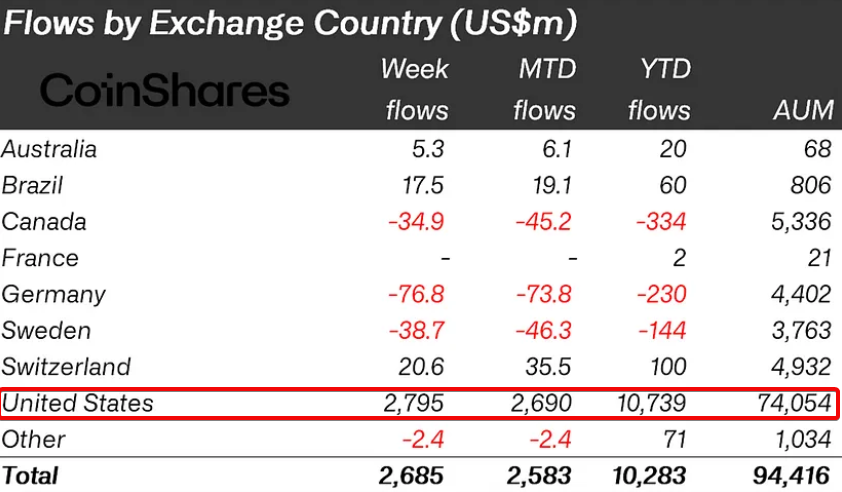

The report also indicates that the recent price uptick has driven total assets under management (AuM) to a new peak of $94.4 billion, showing a robust 14% growth over the past week and an 88% increase since the beginning of the year.

The US Records Over $2.8 Billion in Crypto Inflows to Lead the Market this Week

A regional breakdown shows that the United States leads with $2.8 billion in inflows, followed by Switzerland and Brazil with noteworthy inflows of $21 million and $18 million, respectively. However, Canada, Germany, and Switzerland have seen profit-taking activities, resulting in outflows of $35 million, $77 million, and $39 million, respectively.

Bitcoin remains a focal point for investors, with $2.6 billion in inflows now making up 14% of the total AuM. Interestingly, even with rising prices, short Bitcoin positions have attracted an additional $11 million.

Solana, recovering from recent skepticism, has garnered $24 million in inflows. In contrast, Ethereum, despite solid year-to-date inflows, experienced slight outflows of $2.1 million. Other cryptocurrencies, such as Polkadot, Fantom, Chainlink, and Uniswap, also reported notable inflows ranging from $1.6 million to $2.7 million.

At the time of reporting, Bitcoin was trading at neutral levels around $72,000, with the total crypto valuation surpassing the $2.6 trillion mark. Blockchain equities, however, faced minor outflows totaling $2.5 million.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here

Following a

Following a