October 11, 2023

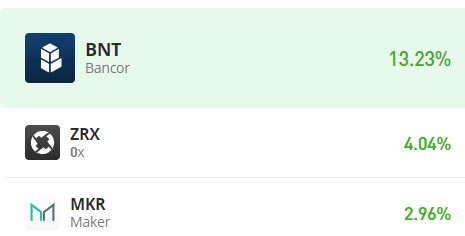

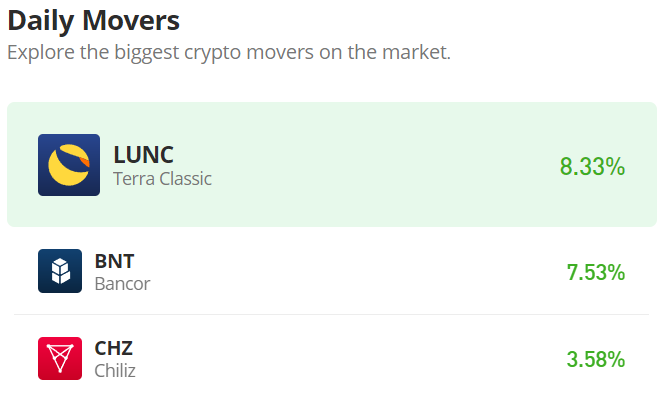

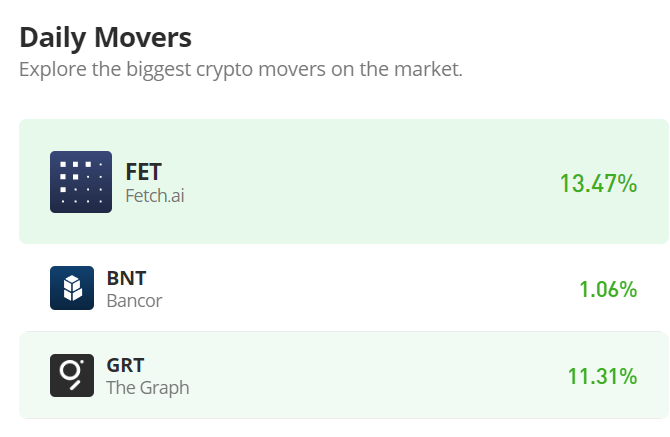

Bancor (BNT/USD) Approaches the $0.800 Price Milestone

The Bancor market has exhibited a sustained price consolidation trend at approximately $0.400 since mid-August. However, on October 8, a significant surge in the bull market propelled the price to $0.700. As the price reached $0.700, many traders began to take profits. Nevertheless, there are still...

Read More