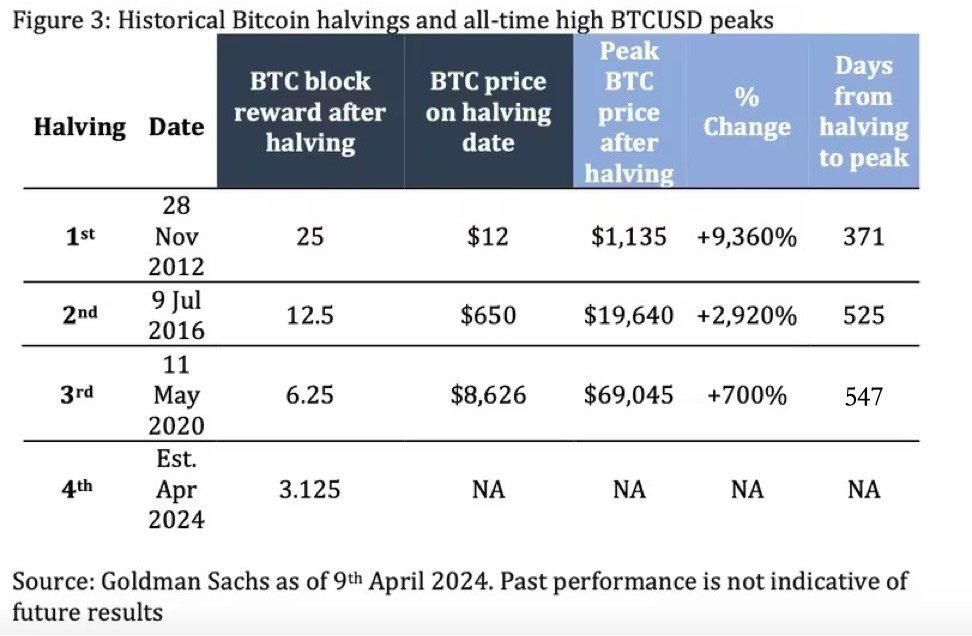

Bitcoin, the pioneering cryptocurrency, is on the brink of its fourth mining-reward halving, set to occur in three days. This significant event, recurring every four years, is expected to exert considerable influence on the cryptocurrency market, with investors eagerly monitoring developments.

During a halving, the reward earned by miners for validating transactions on the Bitcoin network undergoes a halving itself. In this instance, the per-block emission of BTC will diminish from 6.25 BTC to 3.125 BTC. This reduction effectively slashes the influx of new supply into the market.

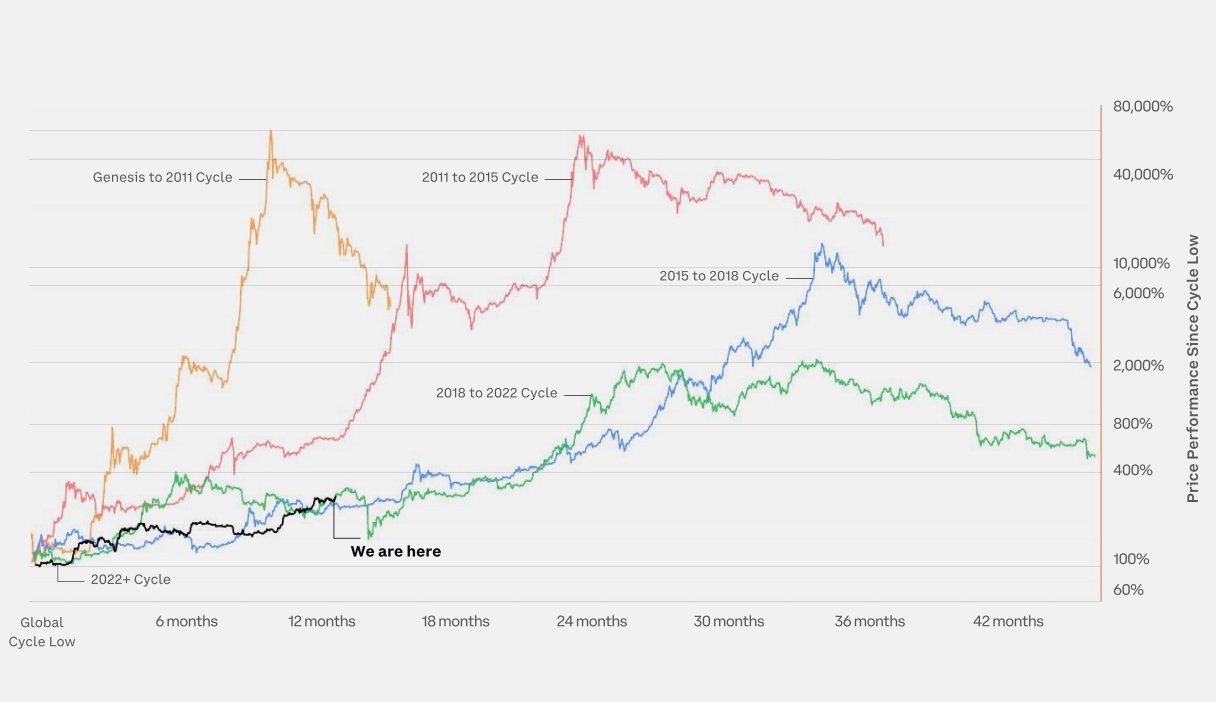

Historically, halvings have been followed by notable appreciations in BTC’s price. Nonetheless, the timing and extent of these surges have displayed notable variation.

Goldman Sachs Advises Caution Ahead of Bitcoin Halving

In a recent disclosure reported by CoinDesk, investment banking titan Goldman Sachs has issued a word of caution to its clientele. While acknowledging the positive correlation between halvings and price escalations, Goldman underscores the necessity of considering the prevailing macroeconomic circumstances.

Diverging from preceding halvings, today’s economic terrain is characterized by elevated inflation and interest rates. Globally, central banks have expanded their M2 money supply, with interest rates holding above zero. These circumstances are pivotal for history to echo itself, as they encourage risk-taking across financial markets, including cryptocurrencies.

Despite the impending halving, Bitcoin’s price has already experienced significant upswings this year. Inflows into U.S.-based spot exchange-traded funds (ETFs) have contributed to a remarkable 45% rally. These ETFs, green-lighted only three months ago, now manage almost $60 billion in assets.

Nevertheless, the present scenario deviates from prior cycles. U.S. interest rates stand beyond 5%, with market projections no longer factoring in rate reductions owing to persistent inflation and a resilient economy.

Certain analysts posit that a substantial portion of the customary post-halving surge has already transpired, potentially leaving room for a sell-the-fact downturn following the halving on April 20. Goldman Sachs perceives the halving as a “psychological reminder” of Bitcoin’s finite supply. The medium-term outlook pivots on the adoption of BTC ETFs.

In essence, while the halving garners attention, the broader supply-demand dynamics and ETF demand will persist as the principal drivers of Bitcoin’s price trajectory. Whether it materializes into a “buy the rumor, sell the news” scenario remains to be witnessed, yet investors are urged to remain cautious and factor in the macroeconomic backdrop.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here