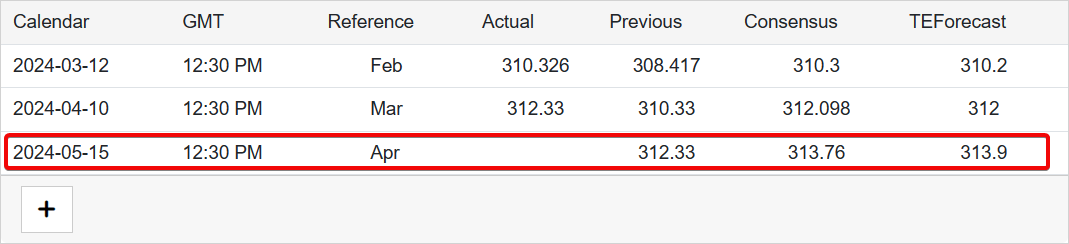

Bitcoin has once again showcased its resilience amidst economic uncertainty, as the U.S. Consumer Price Index (CPI) reported a softer-than-expected increase of 0.3% in April, compared to March’s 0.4% rise and economists’ forecasts.

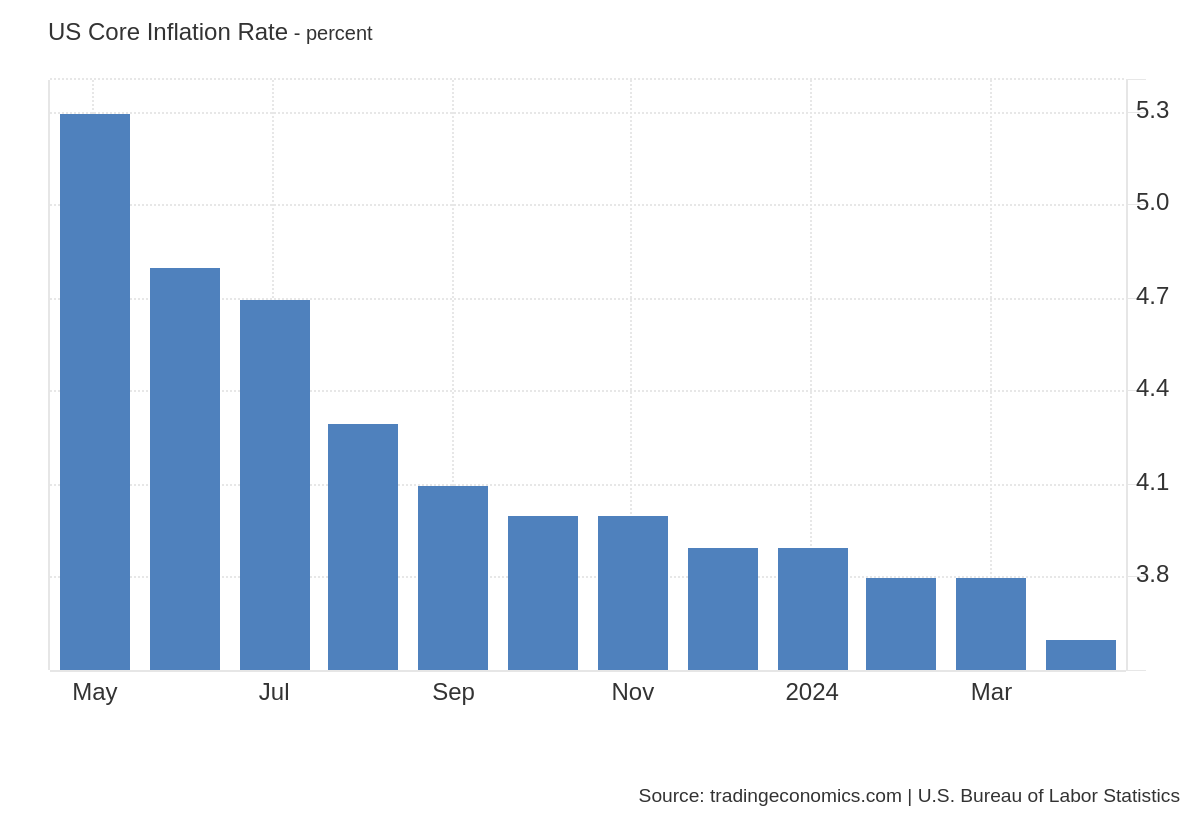

Despite this modest uptick, the annual inflation rate remains significant at 3.4%, slightly lower than March’s 3.5%. The core CPI, excluding food and energy sectors, also rose by 0.3% in April, in line with expectations and down from March’s 0.4%. Year-over-year, core inflation stands at 3.6%, consistent with forecasts but lower than the previous month’s 3.8%.

Bitcoin Jumps to $65,000 Post-CPI Data Release

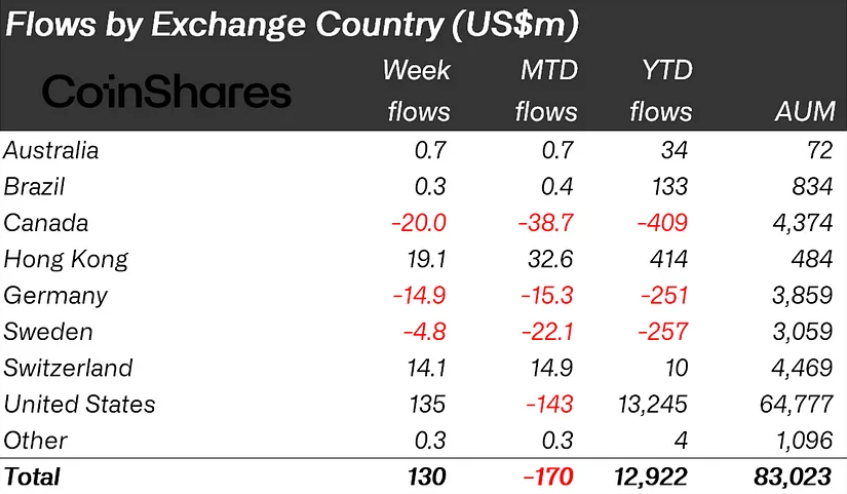

Following the US CPI report earlier today, Bitcoin surged by almost 6%, reaching $65,000. This increase follows a period of stagnation, with no significant inflows into spot ETFs and concerns about high interest rates weighing on the cryptocurrency’s price.

The gradual decline in inflation throughout 2023 has led to expectations of a more lenient monetary policy in 2024. However, the slight increase in inflation this year, alongside ongoing economic growth, has tempered expectations for immediate rate cuts by the U.S. Federal Reserve.

Prior to the CPI data release, the likelihood of a rate reduction this summer was low, with traders estimating only a 50% chance of a cut in September, according to the CME FedWatch Tool.

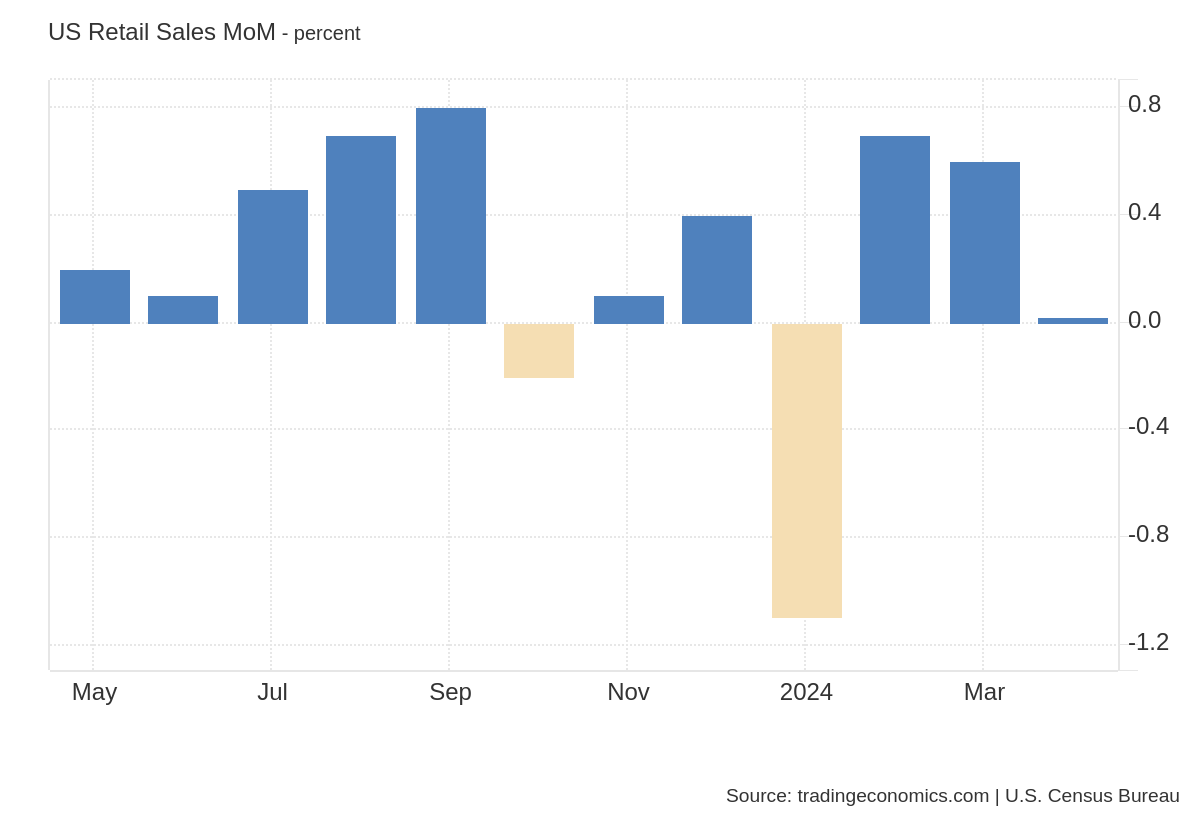

Meanwhile, retail sales figures for April showed no growth, contrary to predictions of a 0.4% increase and below March’s 0.6% rise. Excluding auto sales, retail figures saw a modest 0.2% increase, as expected, but down from the previous month’s 0.9%.

Bitcoin’s resilience in the face of economic uncertainty underscores its growing reputation as ‘digital gold,’ potentially serving as a hedge against inflation and economic volatility. As global markets navigate through these uncertain times, the cryptocurrency market remains a focal point of interest and speculation.

When trading the crypto market, it doesn’t have to be “hit or miss.” Safeguard your portfolio with trades that actually yield results, just like our premium crypto signals on Telegram.

Interested in learning how to day trade crypto? Get all the information you need here

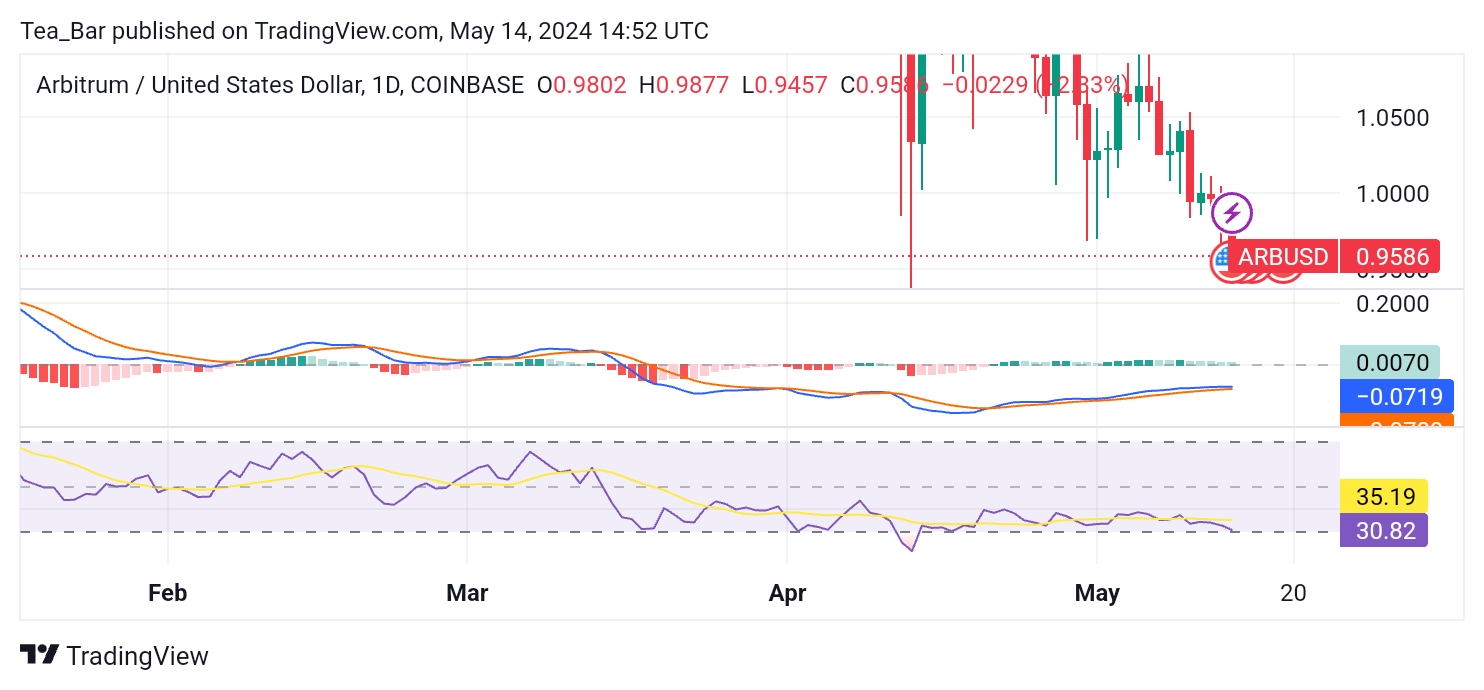

ARB/USD Long-term Trend: Bearish (Daily Chart)

ARB/USD Long-term Trend: Bearish (Daily Chart)